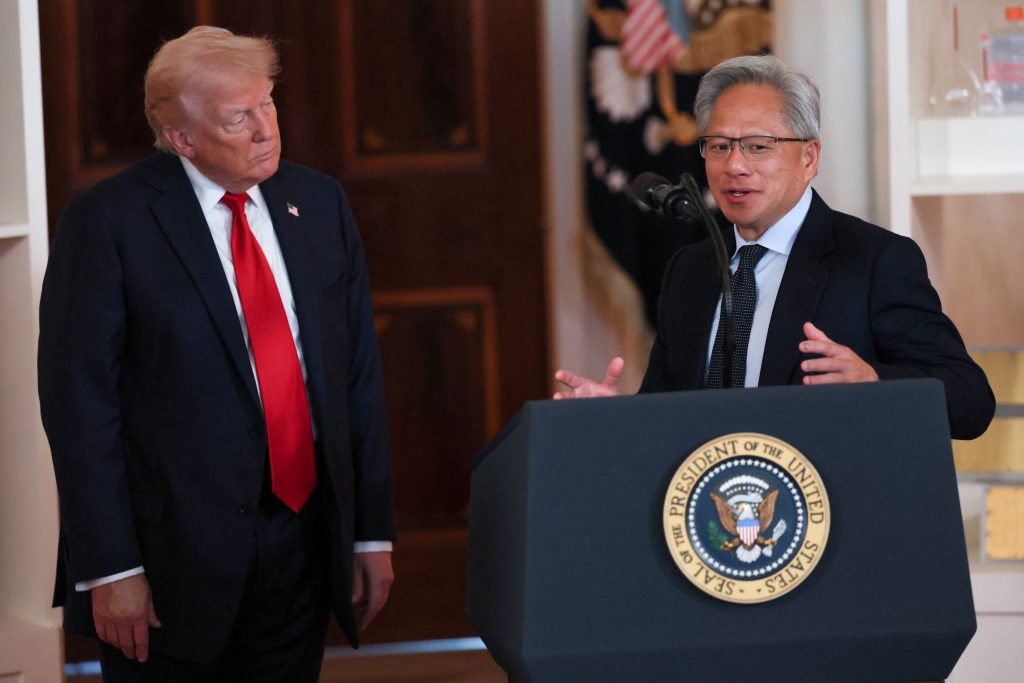

Jensen Huang Just Declared an ‘AI Industrial Revolution’ — and He’s Not Backing Down From Trump or China

PositiveFinancial Markets

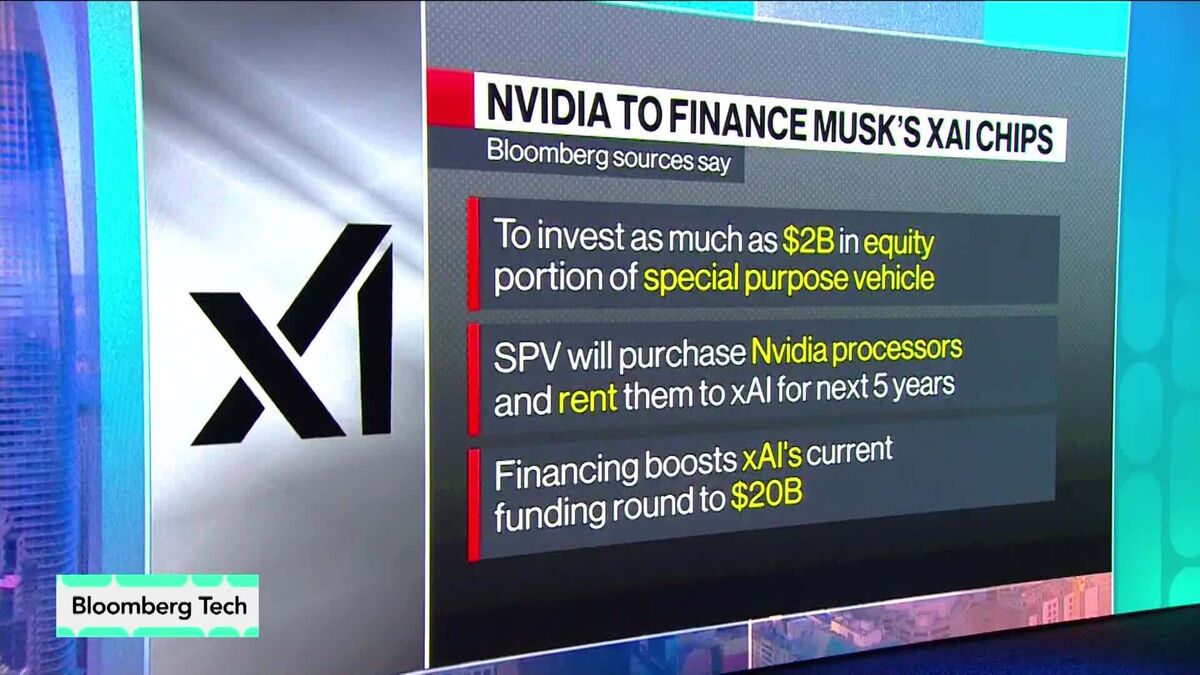

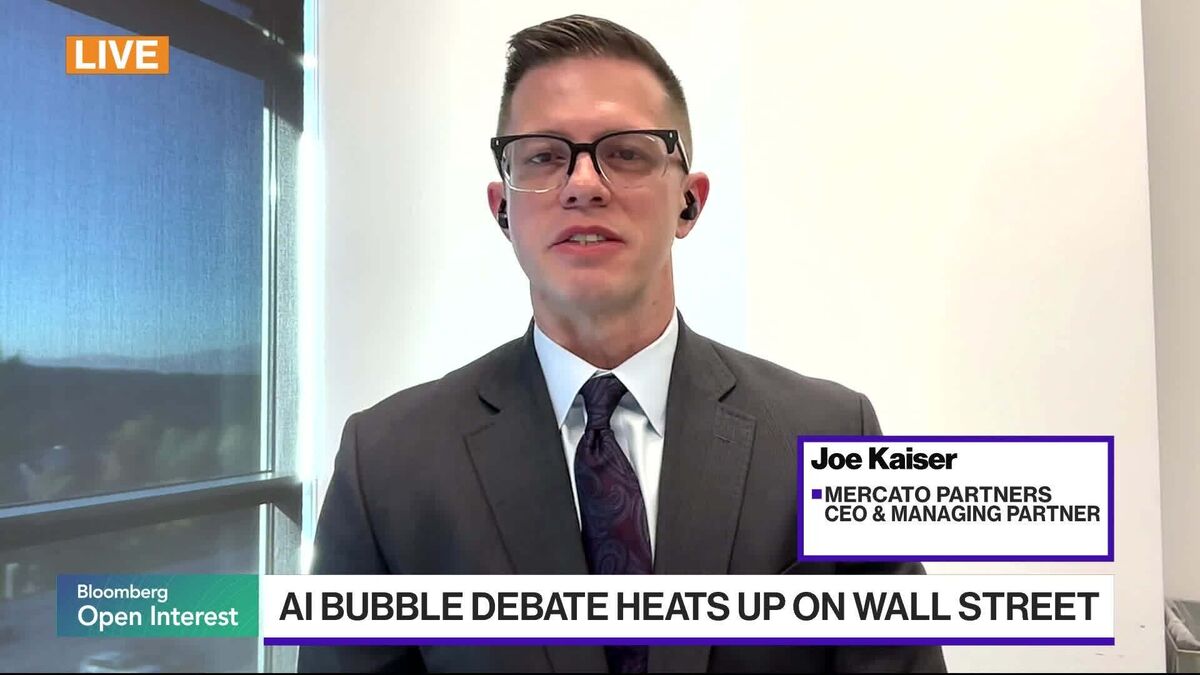

Jensen Huang, the CEO of Nvidia, has boldly declared an 'AI Industrial Revolution' during a recent summit at the White House, where he shared the stage with Donald Trump. This announcement highlights the significant advancements in artificial intelligence and its potential to reshape industries and economies. Huang's confidence in AI's future, coupled with his willingness to engage with political figures like Trump and address challenges posed by China, underscores the urgency and importance of AI development in today's global landscape.

— Curated by the World Pulse Now AI Editorial System