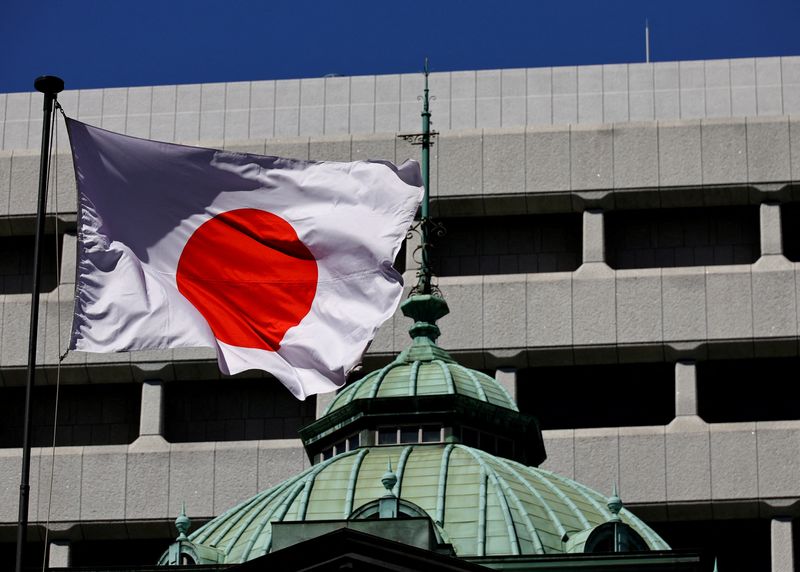

Tepco Shares Rise on Report It Will Start Fund for Niigata

PositiveFinancial Markets

Shares of Tepco, Japan's largest utility, surged following reports that the company plans to establish a fund to support Niigata prefecture, which hosts one of its troubled nuclear power plants. This move is significant as it reflects Tepco's commitment to addressing local concerns and investing in the community, potentially improving its public image and stabilizing its operations in the region.

— Curated by the World Pulse Now AI Editorial System