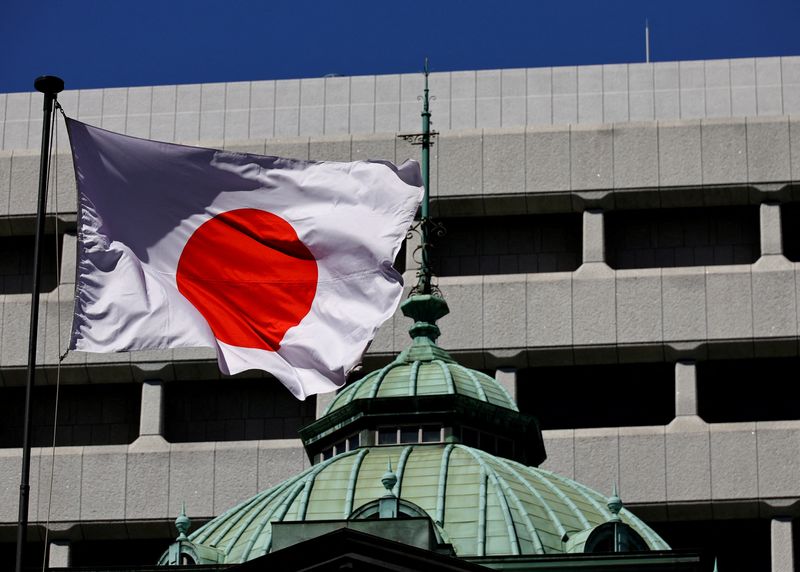

BOJ will find another rate hike this year difficult, says ex-deputy governor

NegativeFinancial Markets

Former Deputy Governor of the Bank of Japan (BOJ) has expressed concerns about the likelihood of another rate hike this year, indicating that the current economic climate poses significant challenges. This matters because it highlights the ongoing struggles within Japan's economy and the potential implications for monetary policy, which could affect everything from inflation to consumer spending.

— Curated by the World Pulse Now AI Editorial System