Foreign Inflow to Japan Stocks Hits Record Just Before LDP Vote

PositiveFinancial Markets

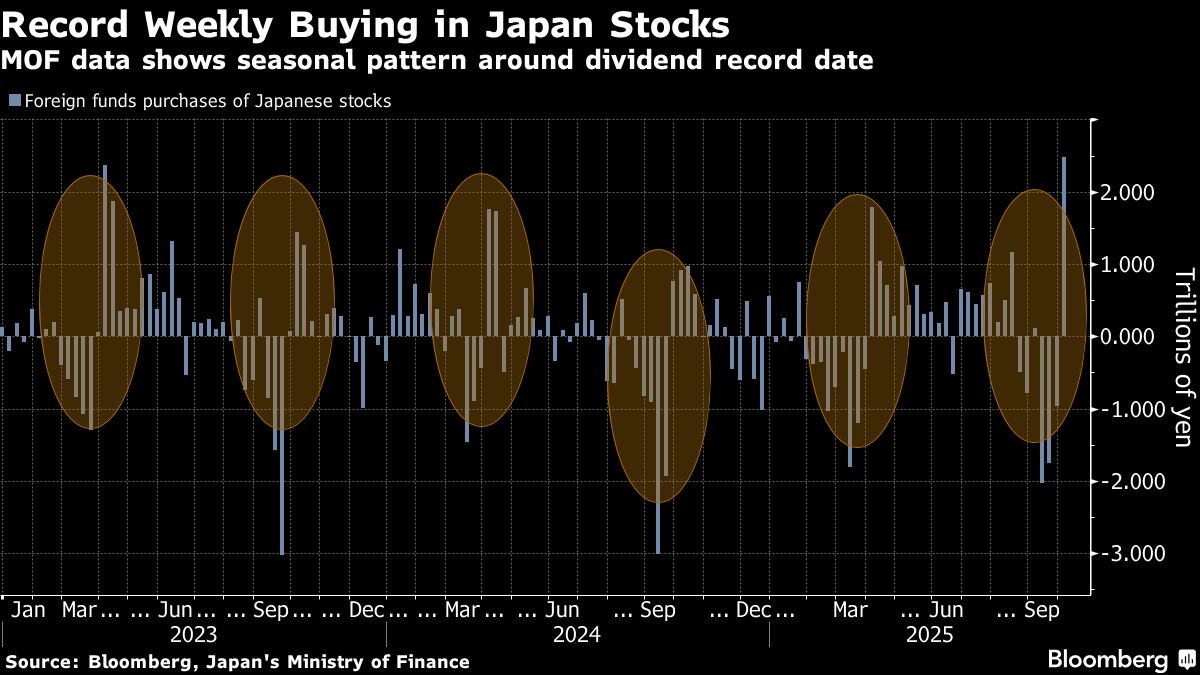

Foreign investors have made a significant move in the Japanese stock market, purchasing a record ¥2.48 trillion ($16.3 billion) worth of stocks last week. This surge in investment comes despite diminishing expectations for a victory by pro-stimulus candidate Sanae Takaichi in the upcoming ruling party election. This trend highlights the growing confidence of foreign investors in Japan's market, which could lead to increased economic stability and growth, making it an important development for both local and international stakeholders.

— Curated by the World Pulse Now AI Editorial System