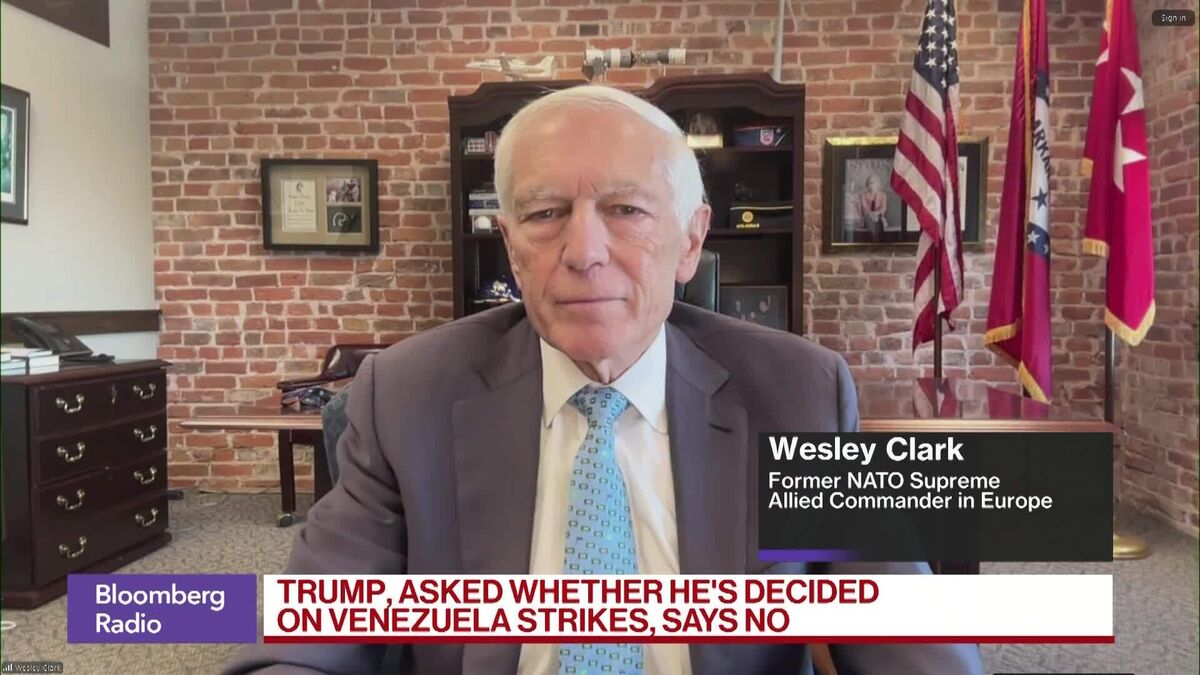

Nobel Peace Prize Winner Says Maduro’s Time Is Up in Venezuela

PositiveFinancial Markets

In a recent interview, Venezuelan opposition leader Maria Corina Machado declared that President Maduro's time in power is coming to an end. She expressed her support for increased US military involvement in Venezuela, highlighting the urgency of the situation. This statement is significant as it reflects the growing discontent with Maduro's regime and the potential for international intervention, which could reshape the political landscape in Venezuela.

— Curated by the World Pulse Now AI Editorial System