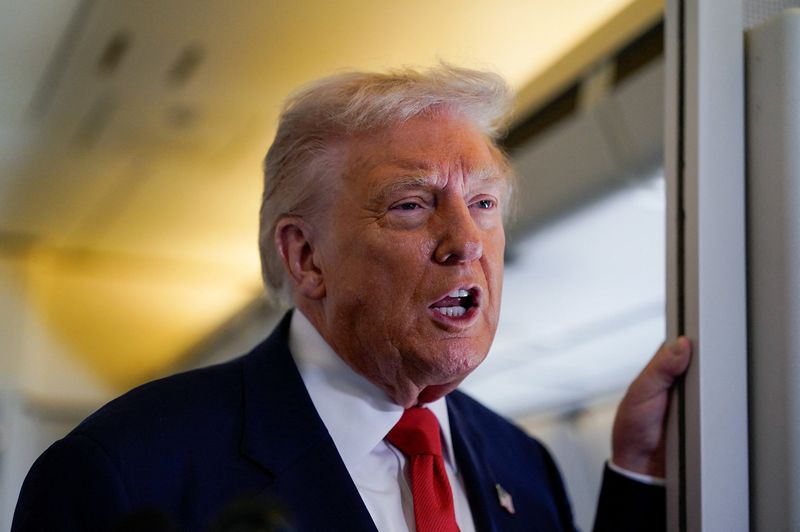

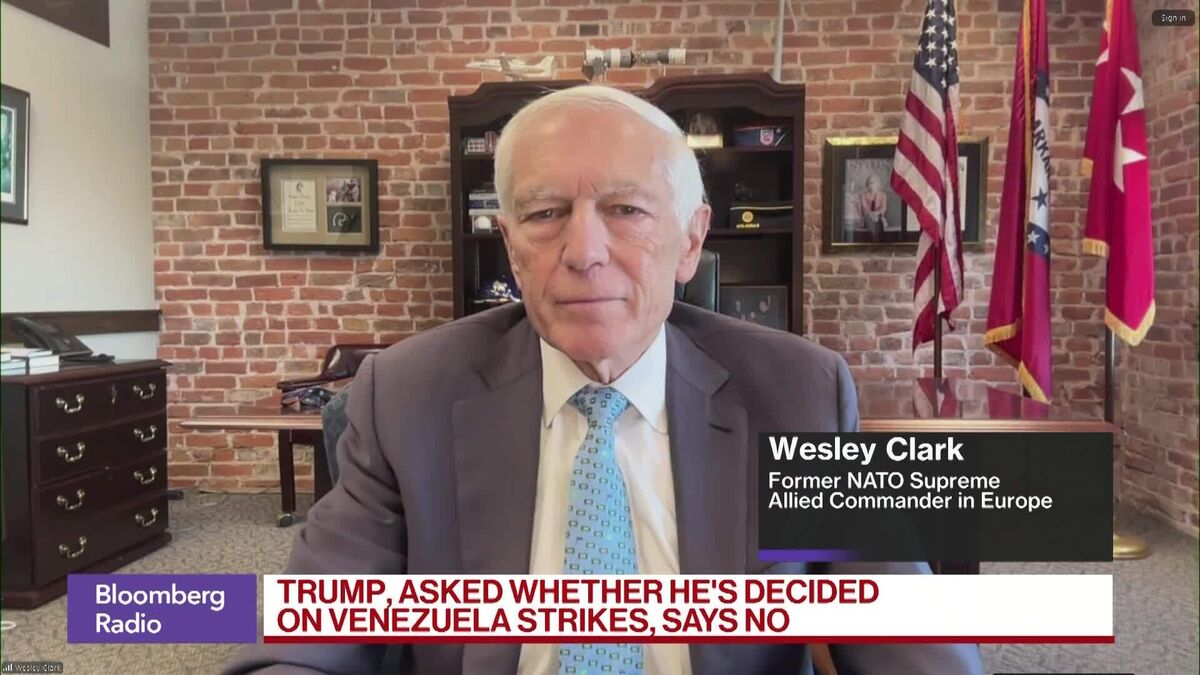

US senators want answers on ’anti-drug’ strategy as Venezuela tensions rise

NeutralFinancial Markets

US senators are seeking clarity on the government's anti-drug strategy amid rising tensions with Venezuela. This inquiry highlights the importance of understanding how U.S. policies are adapting to international challenges, particularly in regions where drug trafficking and political instability intersect. As the situation evolves, the senators' push for answers reflects a broader concern about national security and foreign relations.

— Curated by the World Pulse Now AI Editorial System