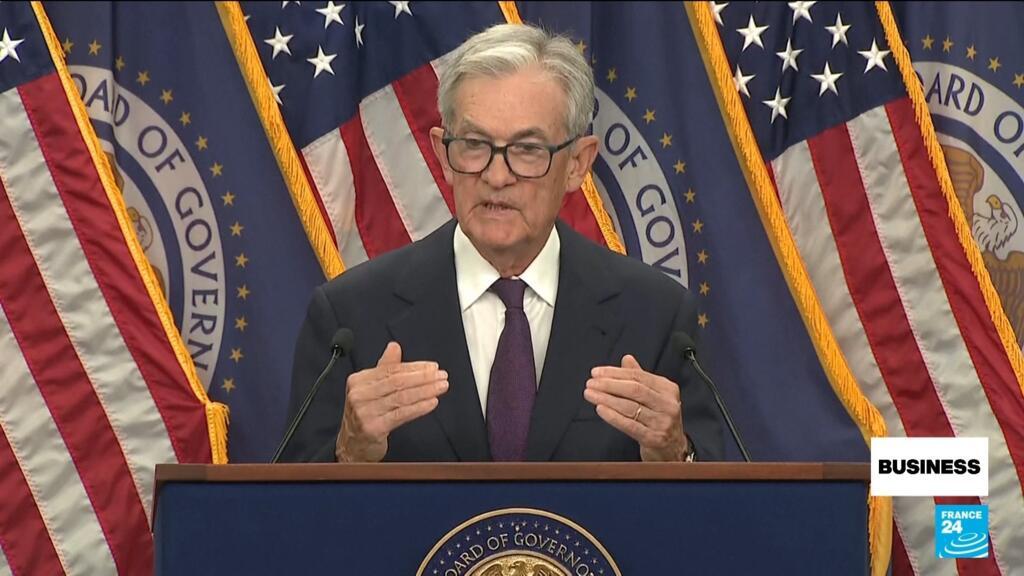

Norges Bank Cuts Key Rate But Hints at Very Gradual Easing Going Forward

PositiveFinancial Markets

Norges Bank has made a significant move by cutting its key interest rate to 4%, signaling a commitment to support economic growth. This decision is crucial as it suggests that the bank anticipates the need for gradual easing over the next few years, with one rate cut expected annually. This approach reflects a careful balance between stimulating the economy and managing inflation, which could positively impact borrowers and businesses alike.

— Curated by the World Pulse Now AI Editorial System