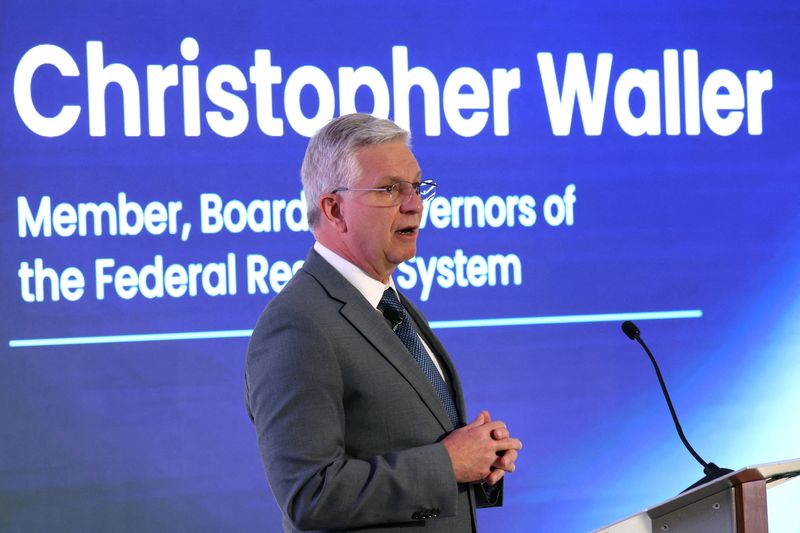

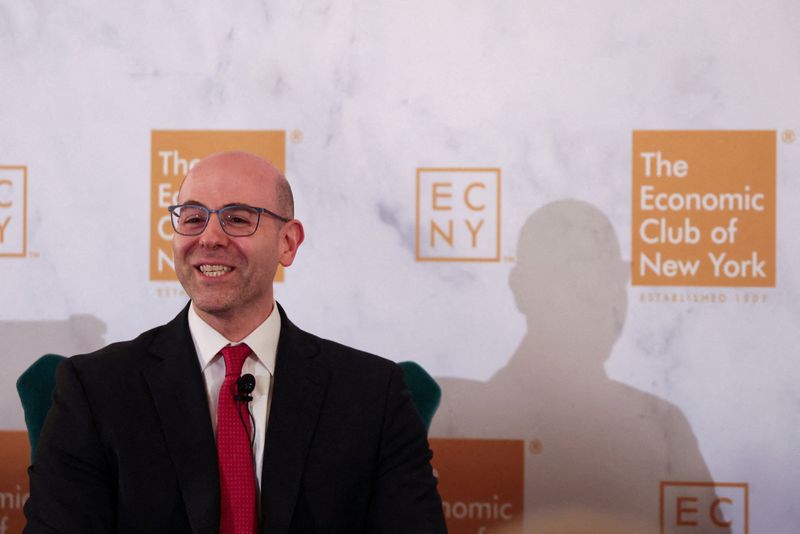

Fed policymakers' focus on tariffs makes central bank seem political: Miran

NeutralFinancial Markets

Fed policymakers are increasingly focusing on tariffs, which some analysts, like Miran, argue makes the central bank appear more political. This shift in focus could influence economic decisions and public perception of the Fed's independence, raising questions about how external factors like trade policies impact monetary policy.

— Curated by the World Pulse Now AI Editorial System