Nvidia’s China chip problem isn’t what most investors think

NeutralFinancial Markets

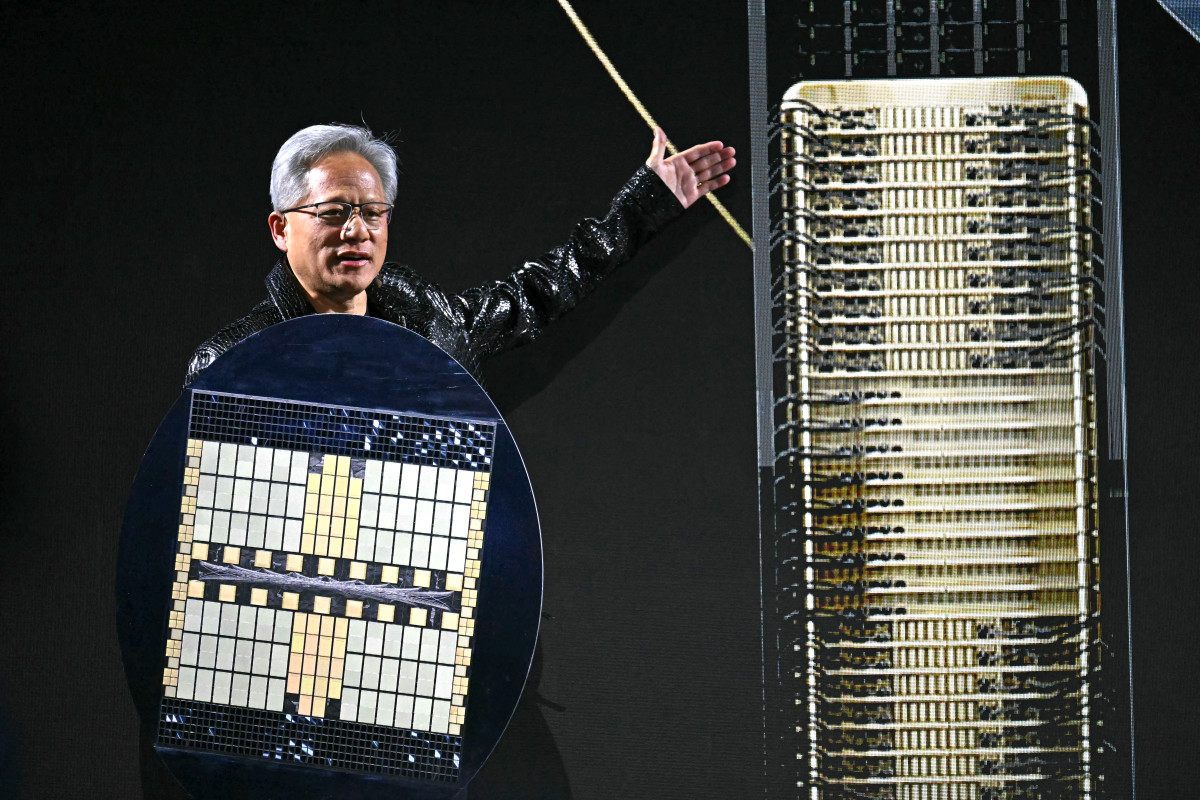

- Nvidia's H200 processor has become a focal point of contention in China, as local cloud and internet companies seek access to the chip, which outperforms their existing accelerators. The U.S. government has recently approved the sale of these advanced AI chips to China, following negotiations that highlight the ongoing complexities in U.S.-China technology relations.

- This approval is significant for Nvidia, as it allows the company to tap into the lucrative Chinese market, where demand for high-performance computing is surging. The decision could bolster Nvidia's market position amid increasing competition from local firms like Moore Threads, which is gaining traction in the semiconductor space.

- The approval of Nvidia's chip sales to China reflects broader geopolitical dynamics, where technology exports are increasingly scrutinized. While this move may enhance Nvidia's business prospects, it also raises concerns about national security and the potential for China to achieve greater self-sufficiency in semiconductor manufacturing, complicating the landscape for U.S. tech firms.

— via World Pulse Now AI Editorial System