Morgan Stanley sets jaw-dropping Micron price target after event

PositiveFinancial Markets

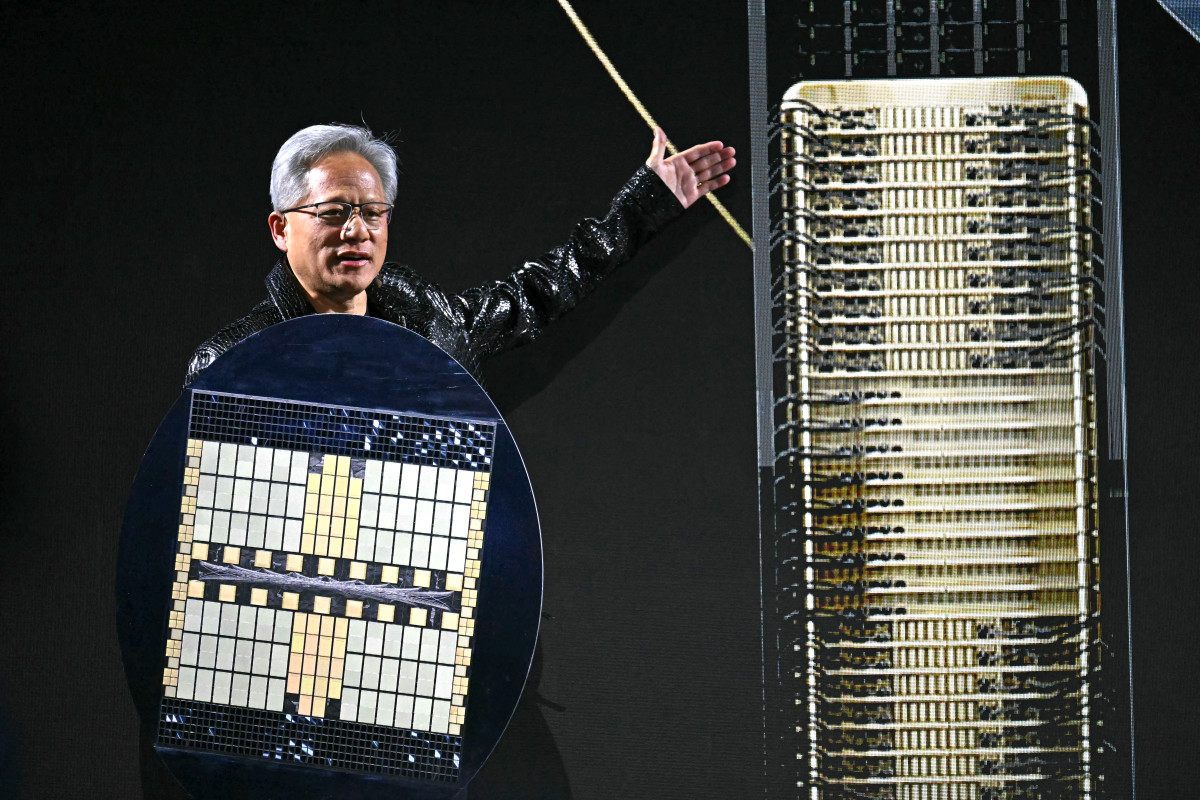

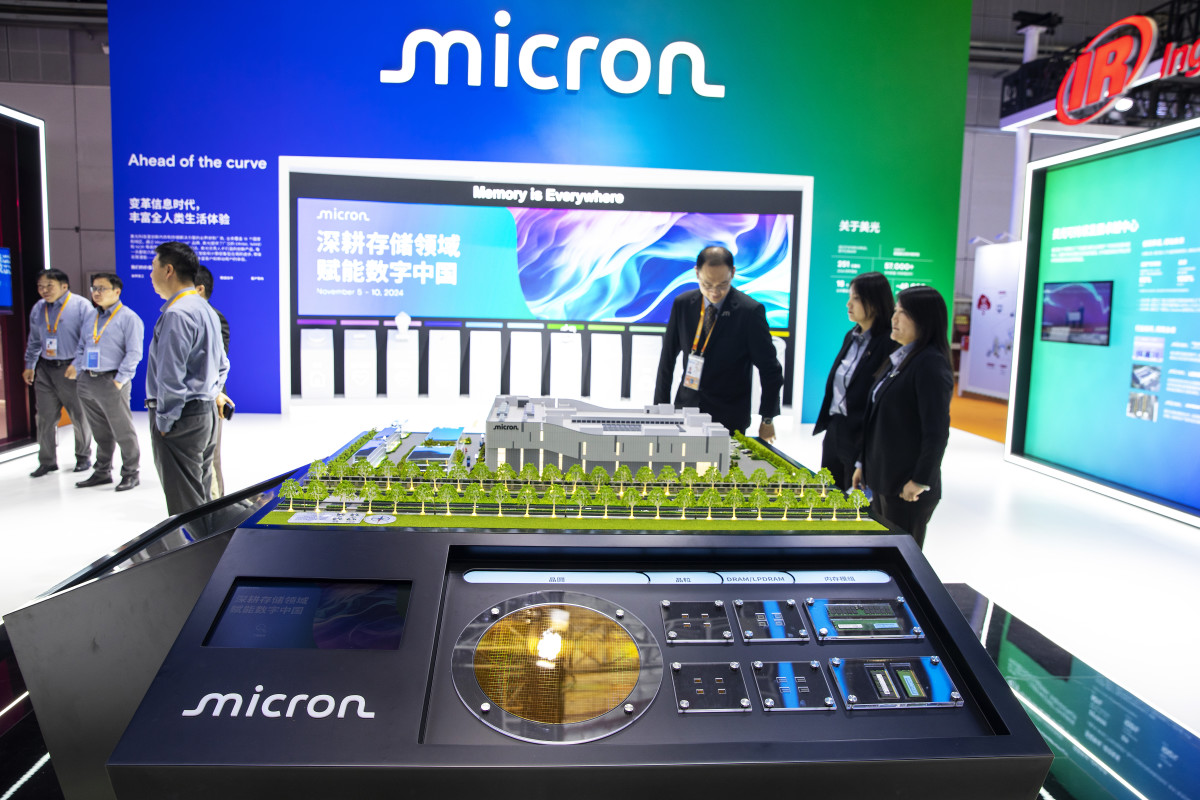

- Morgan Stanley has set a remarkable price target for Micron Technology, highlighting the company's recent quarter as one of the most significant revenue and profit surprises in the U.S. chip industry, second only to Nvidia's performance. This development follows a period of heightened investor interest in semiconductor stocks driven by advancements in artificial intelligence.

- The raised price target reflects Morgan Stanley's confidence in Micron's growth potential, particularly as the demand for memory chips surges due to increased investments in data center infrastructure and AI technologies. This positive outlook is crucial for Micron as it navigates a competitive market landscape.

- This announcement comes amid contrasting market reactions to other semiconductor firms, such as Broadcom, which recently faced a significant stock decline despite strong earnings. Additionally, the broader semiconductor sector is experiencing fluctuations as companies like Nvidia continue to report strong growth, indicating a complex interplay of investor sentiment and technological advancements in the industry.

— via World Pulse Now AI Editorial System