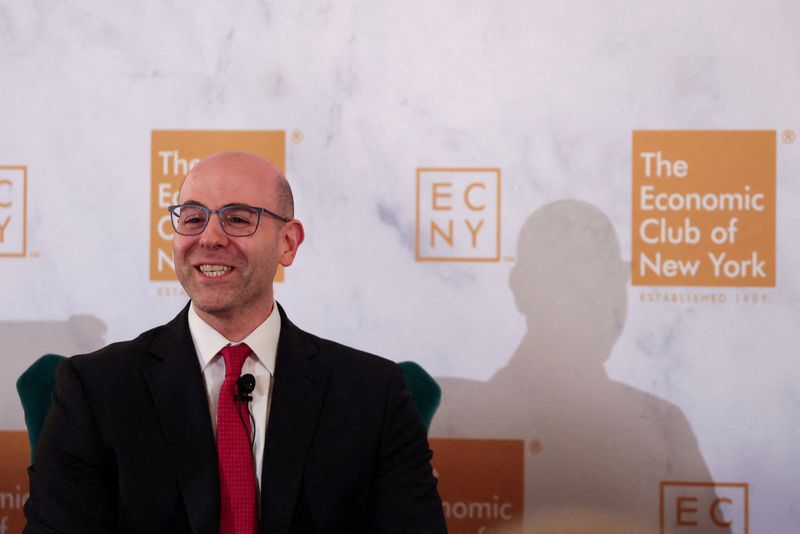

Attempts to fine-tune ECB policy could create undue volatility, Kazimir says

NegativeFinancial Markets

In a recent statement, Kazimir expressed concerns that efforts to adjust the European Central Bank's policies might lead to unnecessary market volatility. This is significant as it highlights the delicate balance the ECB must maintain in managing inflation and economic stability in the Eurozone, especially in uncertain times.

— Curated by the World Pulse Now AI Editorial System