Five Charts Show Pressure Ramping Up on Japan’s Bonds and Yen

NegativeFinancial Markets

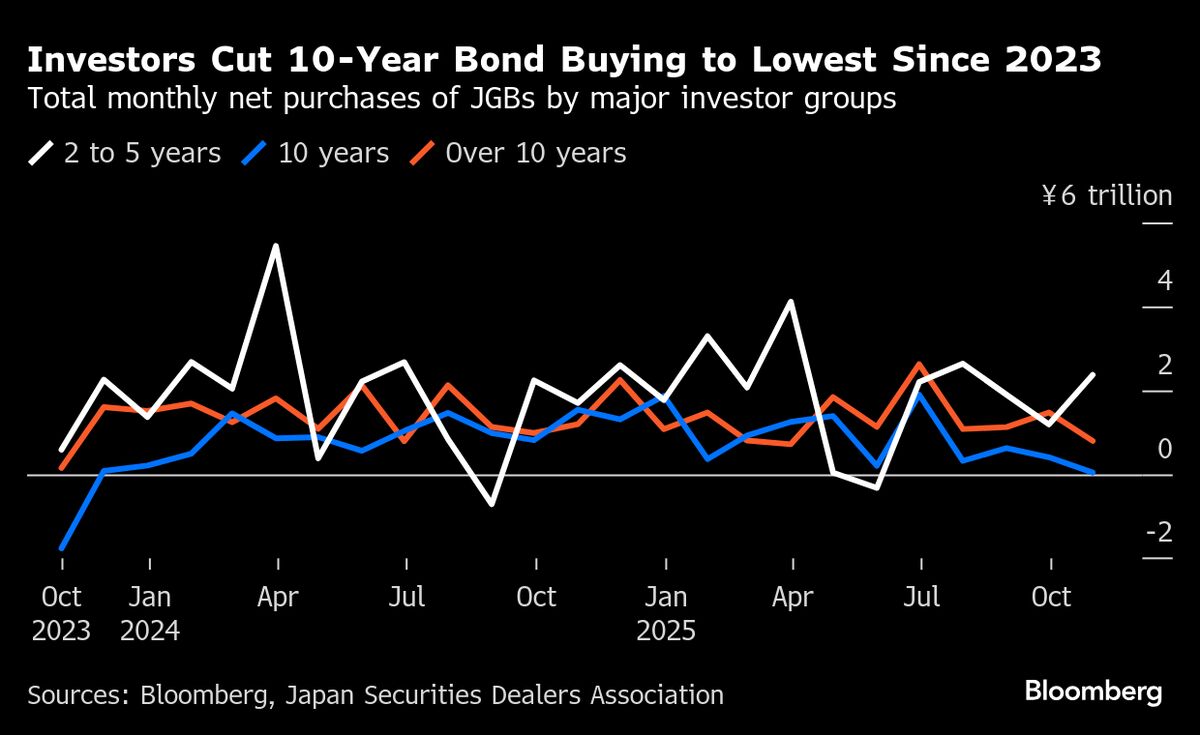

- Japanese markets have experienced significant volatility as both the yen and government bonds face pressure due to Prime Minister Sanae Takaichi's expansive spending plans. This situation has raised concerns among investors about the potential impact on the economy and fiscal stability.

- The decline in the yen's value and the slump in government bonds are critical indicators of market sentiment, reflecting investor apprehension regarding the effectiveness of Takaichi's proposed stimulus measures. This marks a challenging start for her administration.

- The current market dynamics highlight a broader trend of investor caution in response to fiscal policies, as the anticipated stimulus package raises questions about its potential effectiveness. This situation underscores ongoing debates about Japan's economic strategy and the balance between growth and fiscal responsibility.

— via World Pulse Now AI Editorial System