Japan’s Takaichi Faces Market Tests From Yen to Stocks and Bonds

NegativeFinancial Markets

- Japan's new Prime Minister Sanae Takaichi is facing significant market challenges, with approximately $127 billion lost in the value of Tokyo-listed stocks over the past week, alongside sharp declines in the yen and government bonds. This downturn reflects growing investor concerns about her fiscal policies and the effectiveness of her upcoming economic stimulus package.

- The decline in market confidence poses a critical test for Takaichi, as her administration's ability to stabilize the economy is under scrutiny. Investors are particularly anxious about how her fiscal strategies will impact Japan's economic recovery amid existing pressures from global trade dynamics.

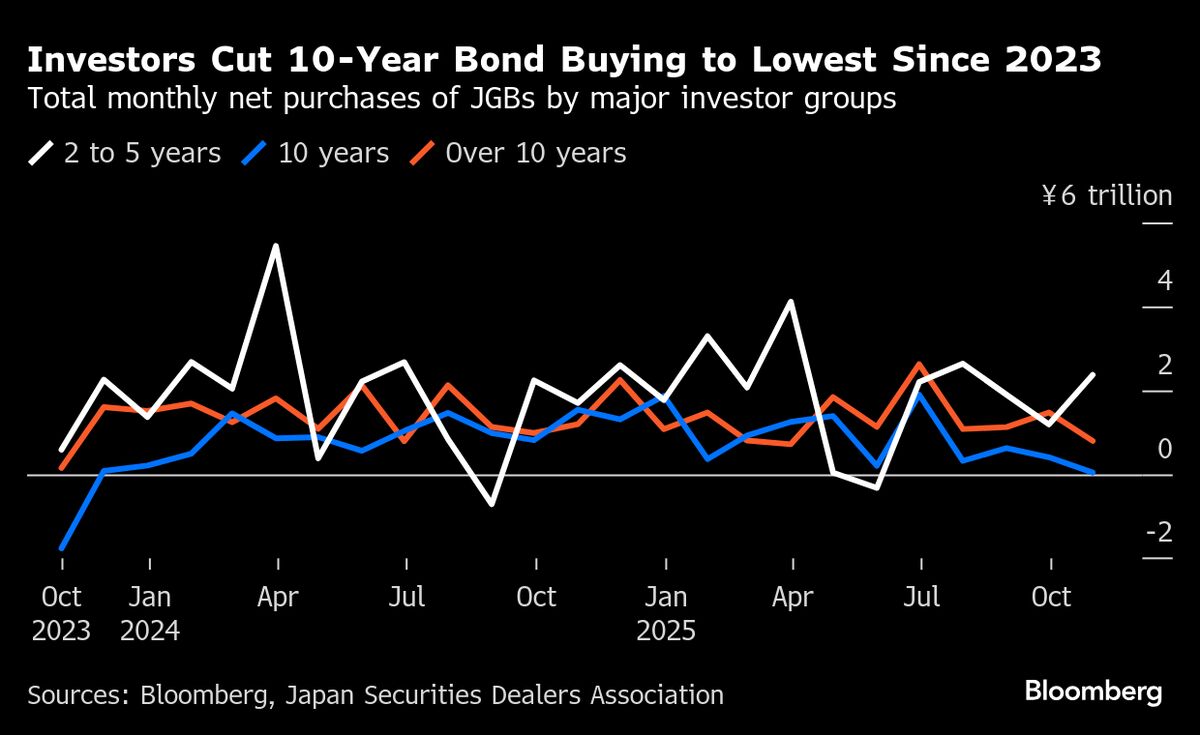

- The current market instability is indicative of broader economic challenges, including the impact of U.S. tariffs on Japan's exports and rising bond yields, which have reached their highest levels since the global financial crisis. These factors contribute to a climate of uncertainty, complicating Takaichi's efforts to implement effective economic measures.

— via World Pulse Now AI Editorial System