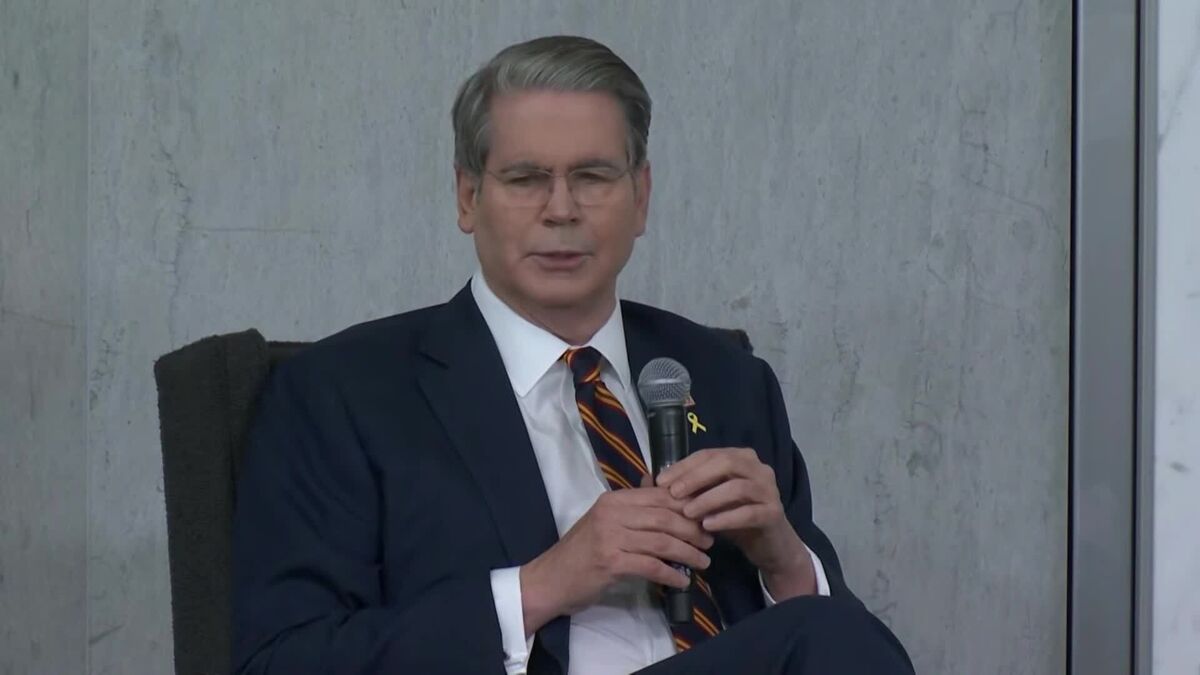

Former US Fed Governor Larry Lindsey withdraws name for Fed chair, CNBC reports

NeutralFinancial Markets

Former US Federal Reserve Governor Larry Lindsey has decided to withdraw his name from consideration for the position of Fed chair, according to a report by CNBC. This development is significant as it reflects the ongoing discussions and potential shifts in leadership within the Federal Reserve, which plays a crucial role in shaping the US economy and monetary policy.

— Curated by the World Pulse Now AI Editorial System