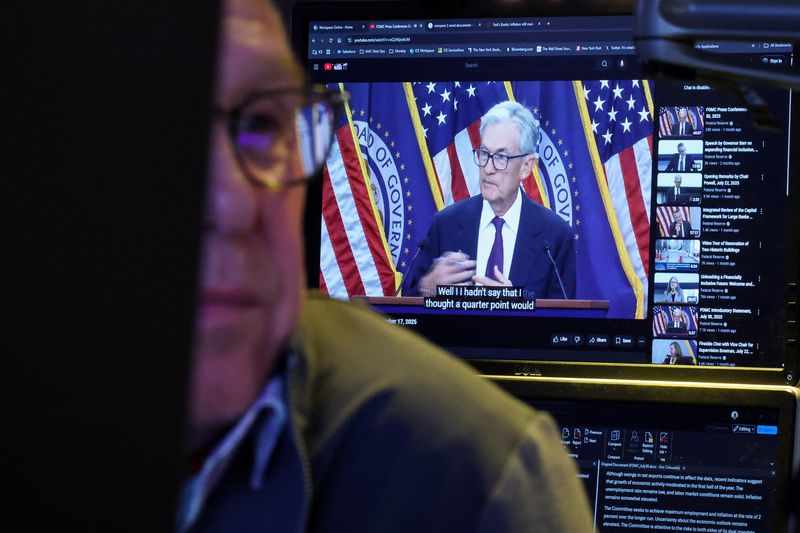

Rise in Fed Funds Rate Signals Potential Liquidity Strain

NegativeFinancial Markets

The recent increase in the effective federal funds rate has raised concerns about potential liquidity strain in the financial markets. This unusual move has led to selling in futures linked to the benchmark, indicating that tighter financial conditions may be on the horizon. It's important to monitor these developments as they could impact borrowing costs and overall economic stability.

— Curated by the World Pulse Now AI Editorial System