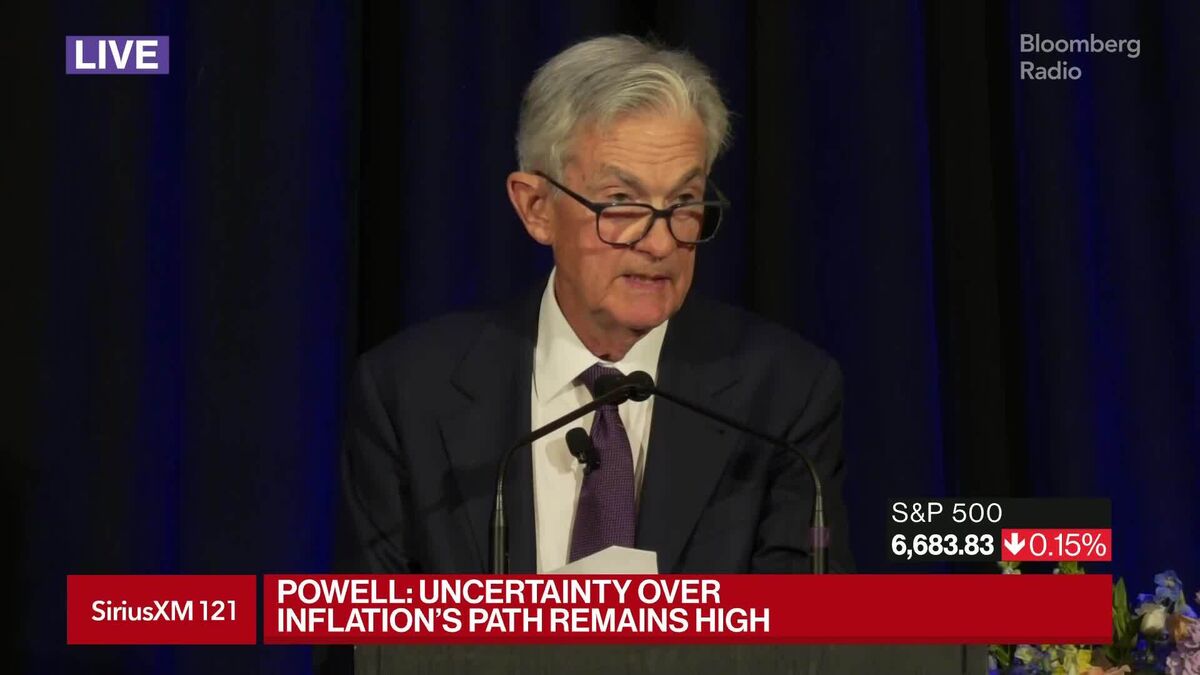

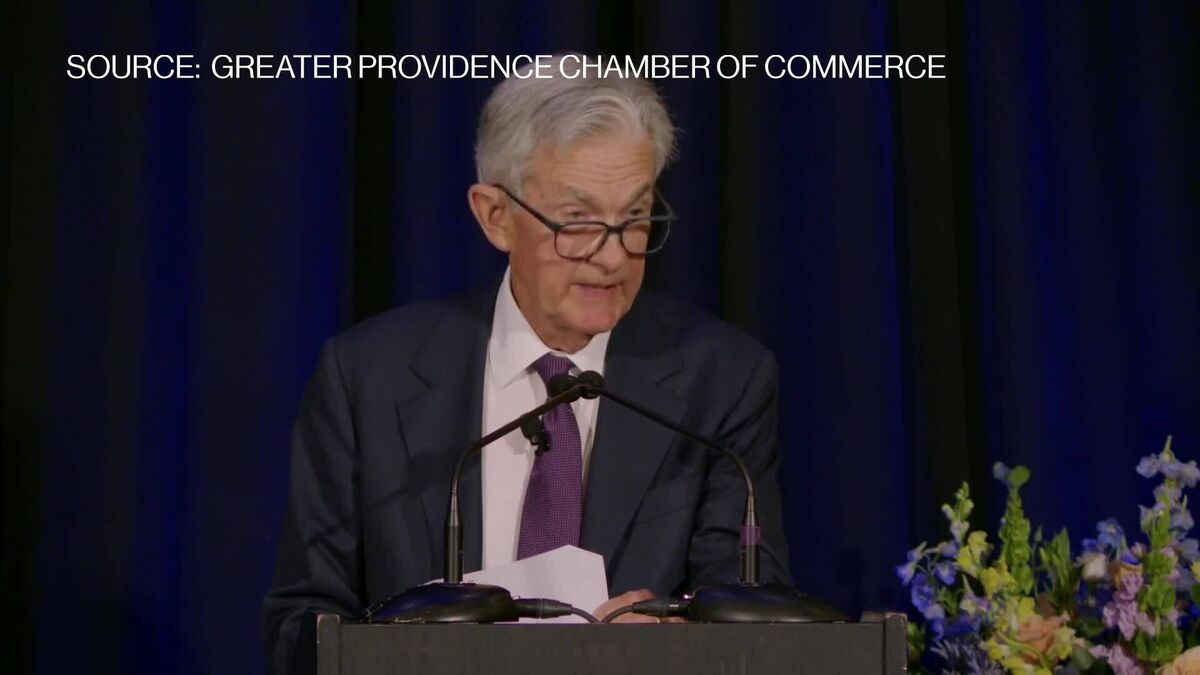

Fed’s Powell signals further US interest rate cuts are not guaranteed

NeutralFinancial Markets

Federal Reserve Chair Jerome Powell has indicated that while the central bank is navigating a complex economic landscape, further interest rate cuts are not assured. This is significant as it highlights the Fed's careful balancing act between managing inflation risks and responding to a softening jobs market, which could impact economic growth and consumer confidence.

— Curated by the World Pulse Now AI Editorial System