Markets anxious over Japan’s risk of ’negative spiral,’ top bank MUFG exec says

NegativeFinancial Markets

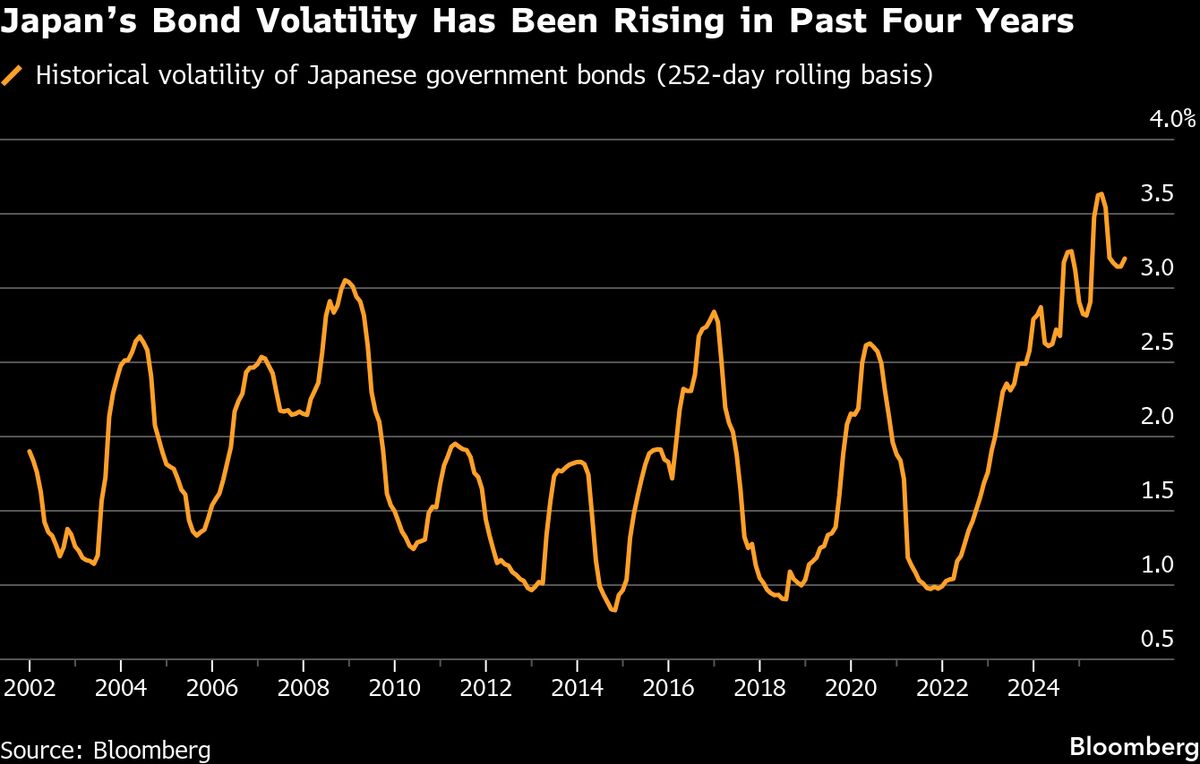

- Japan's financial markets are currently experiencing heightened anxiety over the risk of a 'negative spiral,' as articulated by a senior executive from MUFG. This sentiment is underscored by recent economic indicators and investor reactions to fiscal policies and market instability.

- The implications of this situation are significant for Japan's economic landscape, particularly as investor confidence wanes amid fears of potential interest rate cuts and ineffective fiscal measures. This could lead to further market volatility and economic contraction.

- Broader economic trends reveal a pattern of instability in Japan, with recent stock selloffs, a shrinking GDP, and rising bond yields contributing to a climate of uncertainty. Policymakers are under pressure to respond effectively to these challenges, as the potential for intervention in currency markets and shifts in fiscal strategy loom large.

— via World Pulse Now AI Editorial System