Japan Is Out Spending. Bond Markets Seem Nervous About Picking Up the Tab.

NeutralFinancial Markets

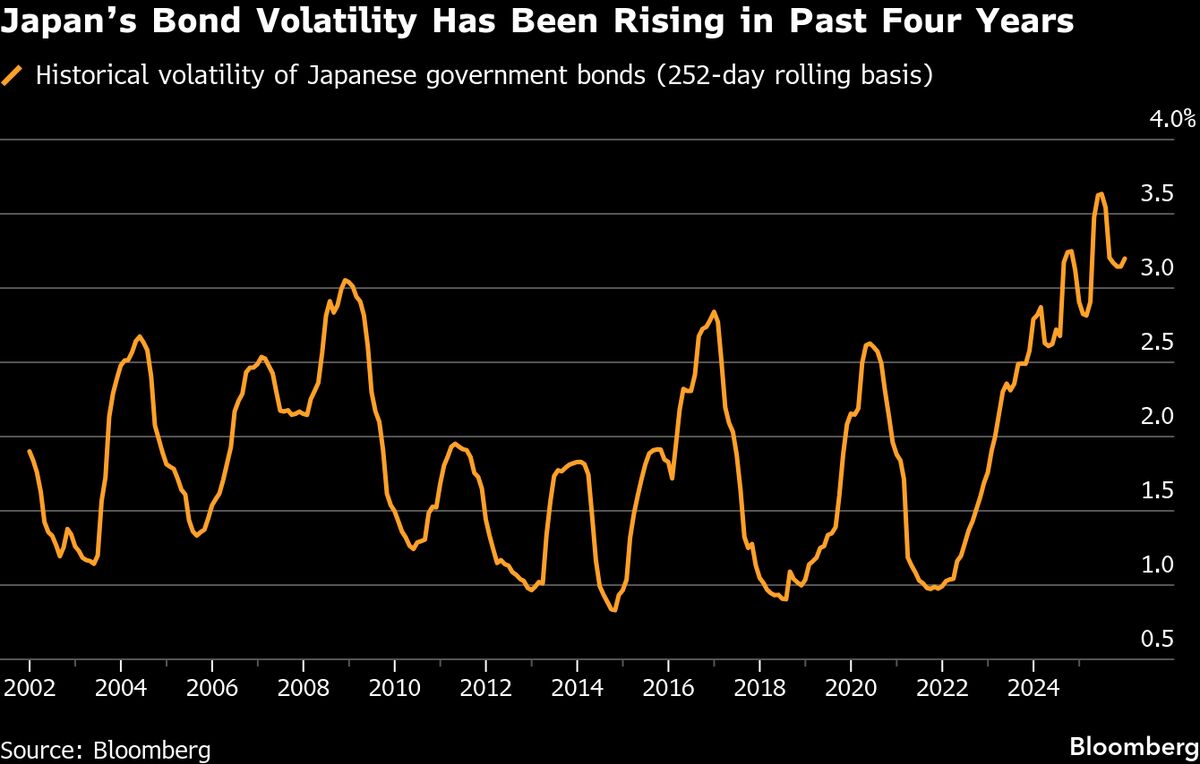

- Japan's Prime Minister Sanae Takaichi has announced plans to increase government spending, coinciding with discussions within the central bank about potentially raising interest rates. This move aims to stimulate economic growth amid ongoing challenges in the financial markets.

- The proposed increase in spending is significant as it reflects Takaichi's commitment to revitalizing Japan's economy, which has faced stagnation. However, it raises concerns about the sustainability of fiscal policies and the potential burden on bond markets.

- The announcement has led to heightened scrutiny of Japan's fiscal health, with bond markets reacting negatively due to fears of increased debt and inflation. Investors are particularly cautious about the implications of Takaichi's expansive fiscal approach, as it may impact the stability of the yen and government bonds.

— via World Pulse Now AI Editorial System