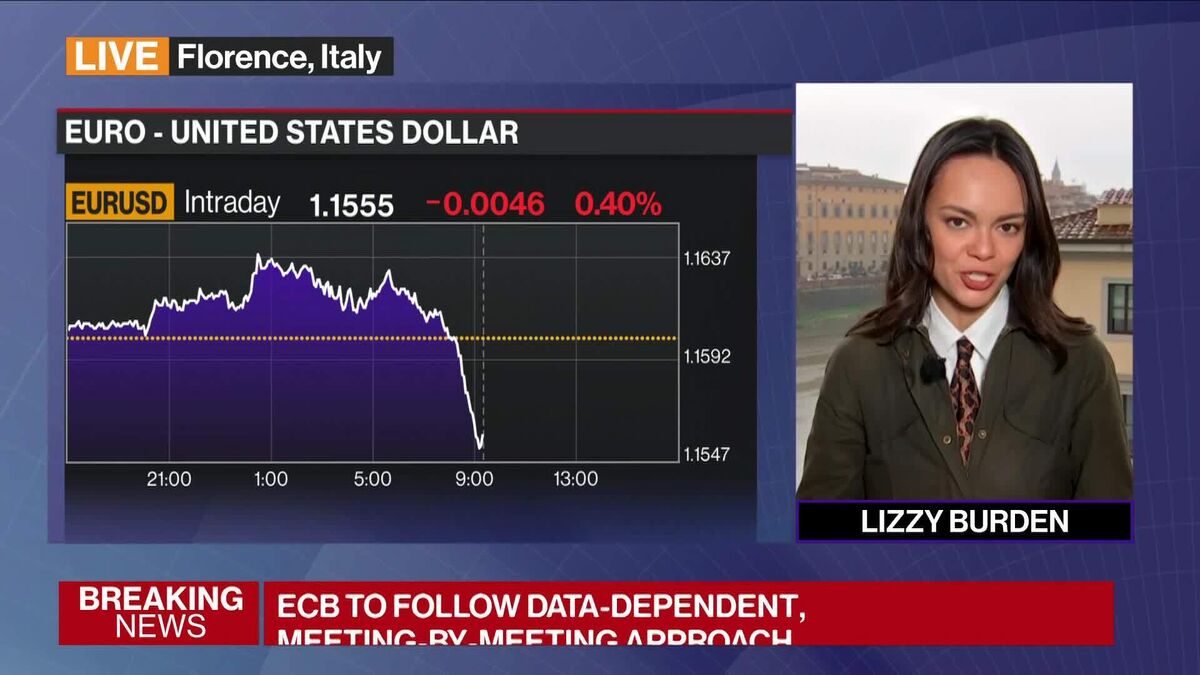

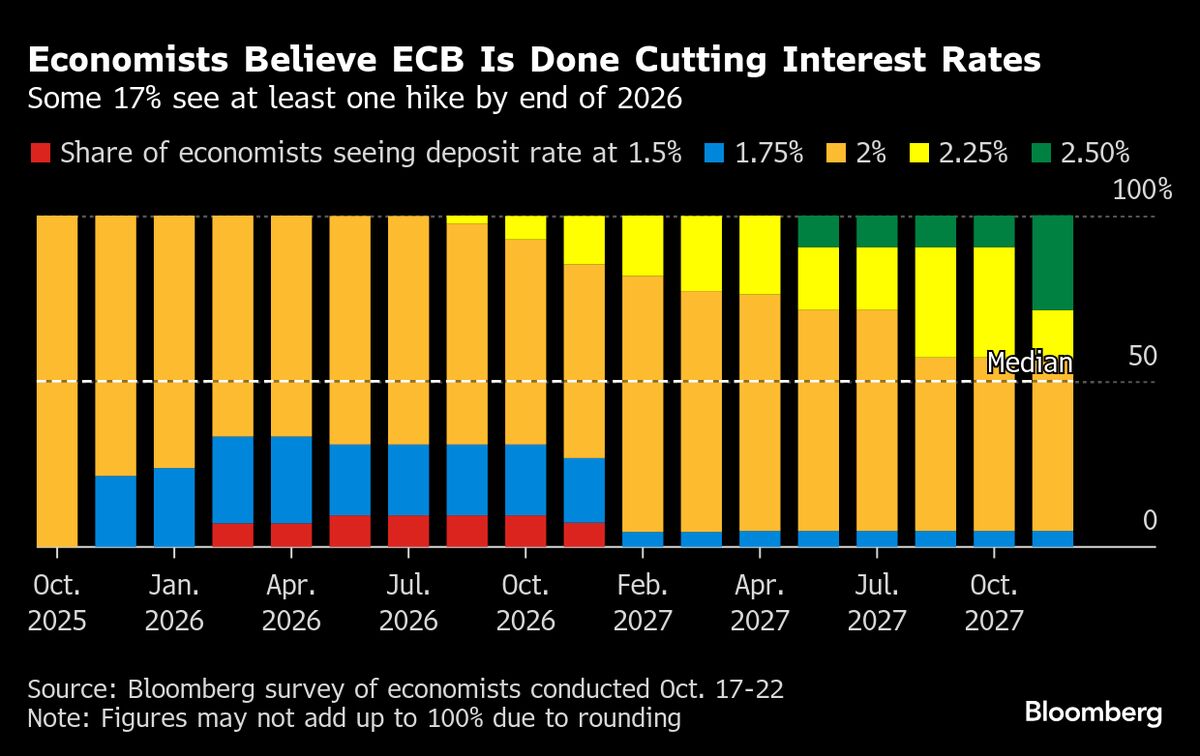

The ECB held interest rates steady for the third meeting in a row

NeutralFinancial Markets

The European Central Bank has decided to keep interest rates unchanged for the third consecutive meeting. This decision reflects the bank's cautious approach to economic conditions in the Eurozone, aiming to balance growth and inflation. It matters because stable interest rates can influence borrowing costs for consumers and businesses, impacting overall economic activity.

— Curated by the World Pulse Now AI Editorial System