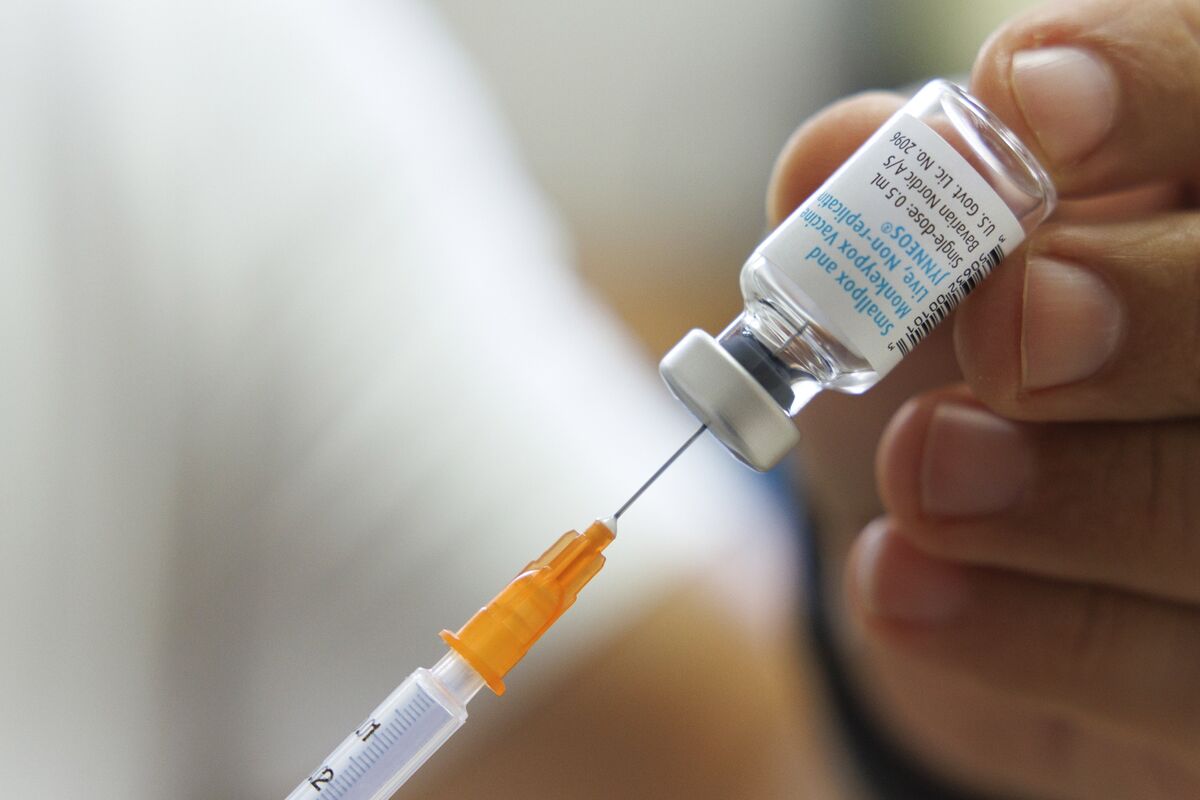

Bavarian Nordic’s Largest Shareholder Stands Firm Against $3.1 Billion Private-Equity Takeover Bid

NegativeFinancial Markets

Bavarian Nordic's largest shareholder, ATP, has firmly rejected a $3.1 billion takeover bid from private-equity firms, raising concerns about the future of the deal. This rejection is significant as it highlights the challenges private-equity firms face in acquiring companies, especially in the healthcare sector, where stakeholders often have differing views on value and strategy.

— Curated by the World Pulse Now AI Editorial System