Bavarian Nordic Deal in Doubt as Shareholder Rejects New Offer

NegativeFinancial Markets

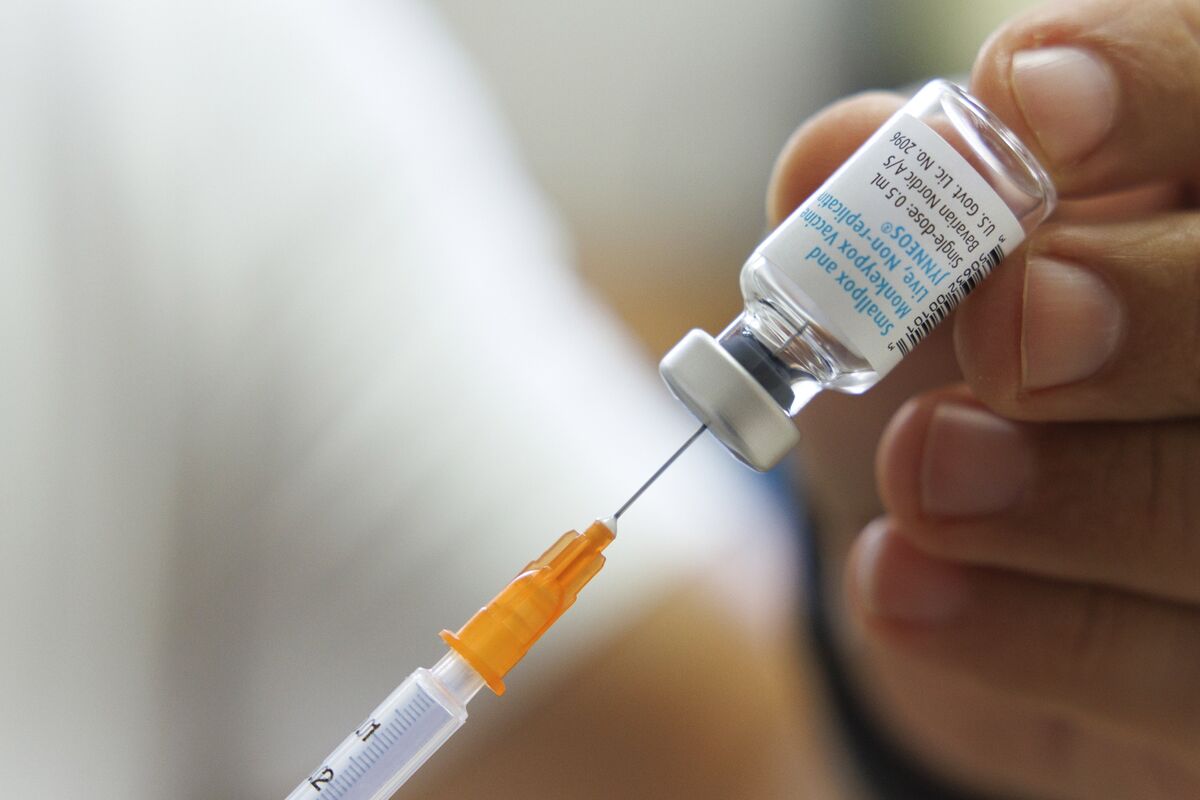

Bavarian Nordic A/S is facing a setback as its largest shareholder has rejected a new, improved takeover offer, creating uncertainty around the future of the company. This development is significant as it not only affects the potential acquisition but also raises questions about the company's stability and strategic direction in the competitive vaccine market.

— Curated by the World Pulse Now AI Editorial System