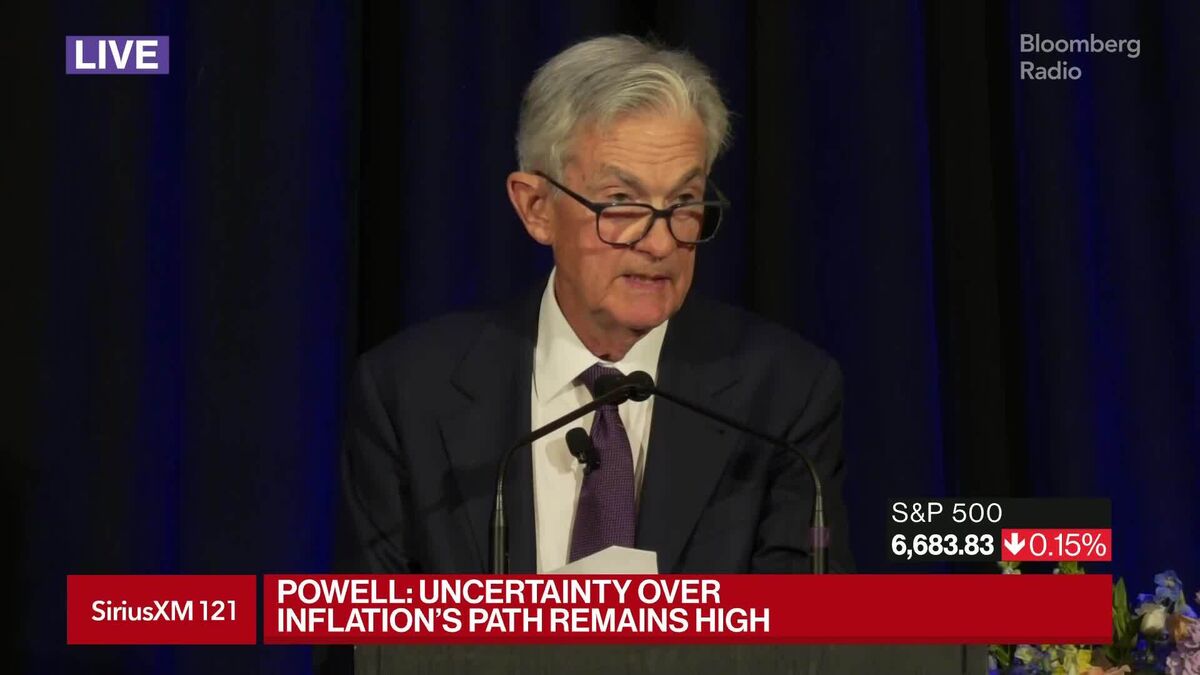

Asia Poised for Muted Start as Powell Holds Back: Markets Wrap

NeutralFinancial Markets

Asian markets are expected to have a subdued start as the recent decline in major tech stocks has interrupted the S&P 500's three-day winning streak. Mixed messages from Federal Reserve Chair Jerome Powell and other officials have created uncertainty regarding future interest-rate cuts. This situation is significant as it reflects the ongoing volatility in the market and the cautious approach investors are taking amidst fluctuating economic signals.

— Curated by the World Pulse Now AI Editorial System