Dow, S&P Slide on AI Worries as Shutdown Looms | The Close 10/7/2025

NegativeFinancial Markets

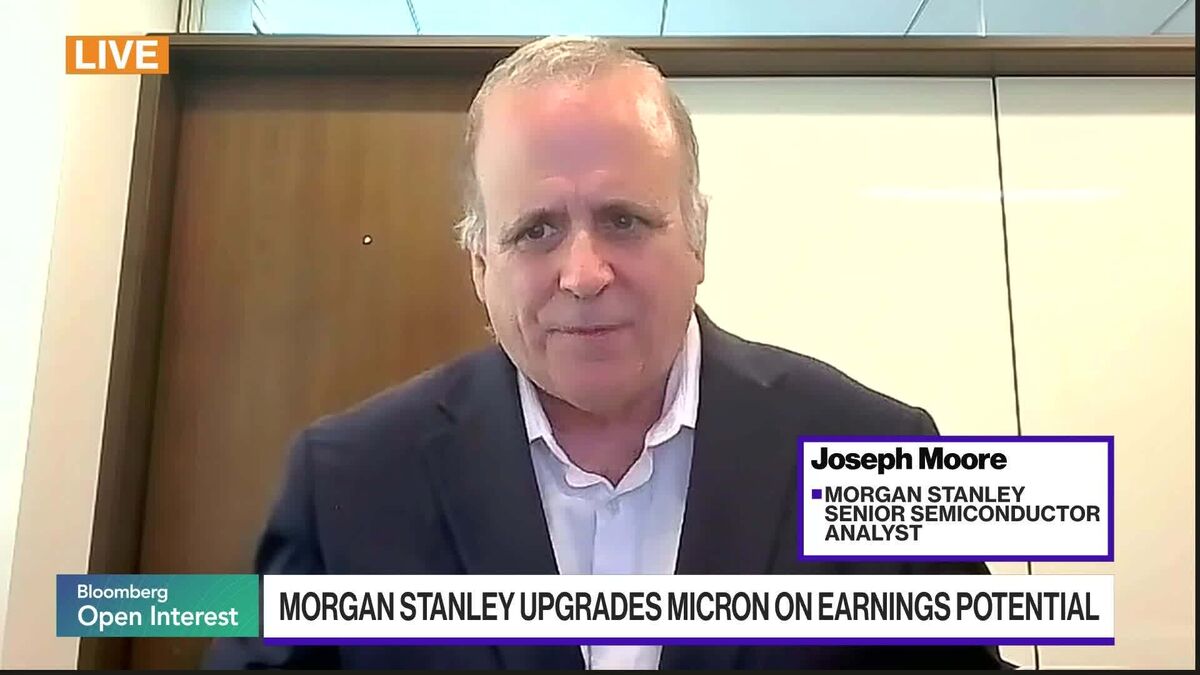

The stock market faced a downturn as concerns over artificial intelligence and a potential government shutdown weighed heavily on investor sentiment. With major indices like the Dow and S&P slipping, experts from top financial firms discussed the implications of these challenges on Bloomberg Television. This matters because it highlights the fragility of market confidence amid economic uncertainties, which could affect investment strategies and consumer spending.

— Curated by the World Pulse Now AI Editorial System