Japan auto sector confidence dives, manufacturers’ index logs first fall in four months: Reuters poll

NegativeFinancial Markets

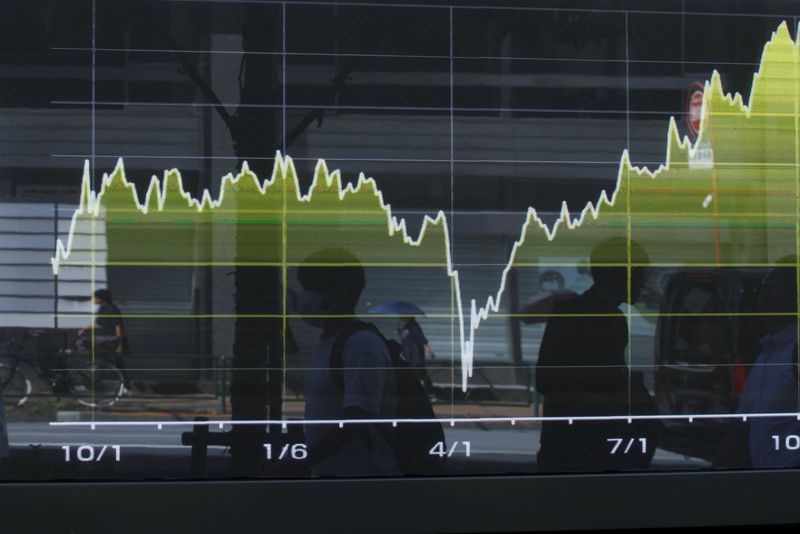

Confidence in Japan's auto sector has taken a significant hit, as a recent Reuters poll reveals that the manufacturers' index has recorded its first decline in four months. This downturn is concerning for the industry, as it may indicate challenges ahead for production and sales, impacting not only manufacturers but also the broader economy. Understanding these shifts is crucial for stakeholders and consumers alike, as they navigate the evolving landscape of the automotive market.

— Curated by the World Pulse Now AI Editorial System