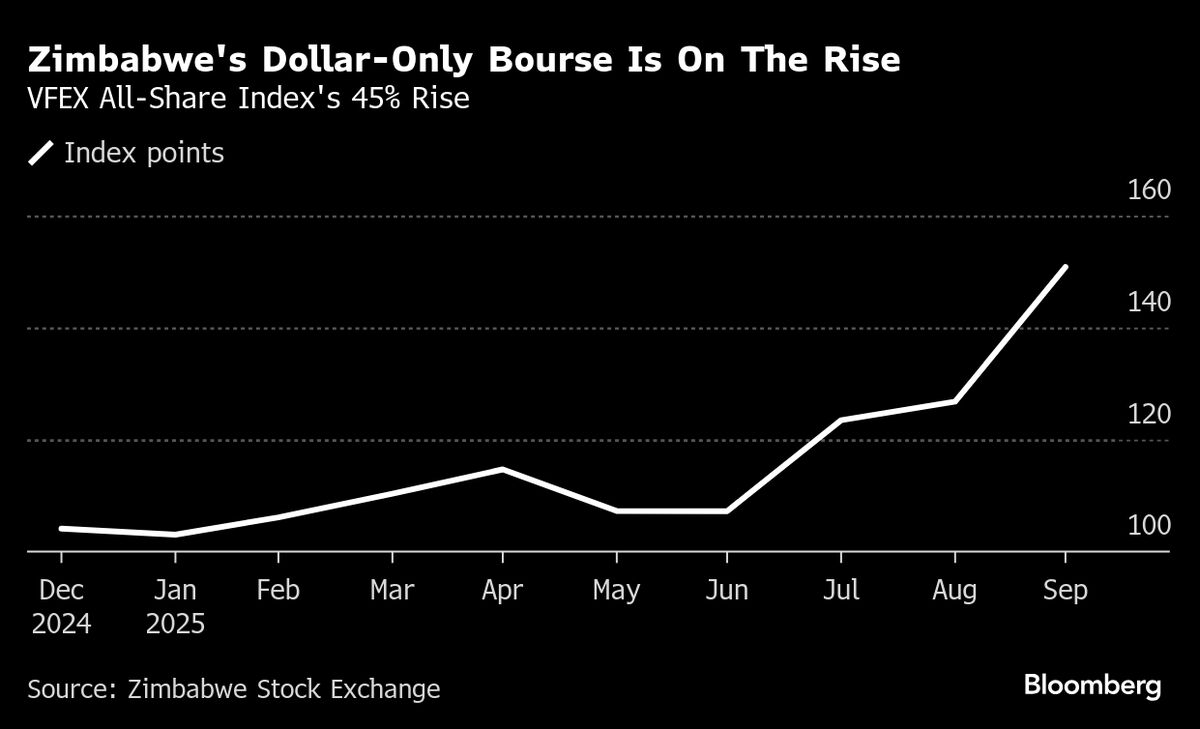

IMF Wants Clarity From Zimbabwe on Plans to End Dollar Usage

NeutralFinancial Markets

The International Monetary Fund (IMF) is seeking more clarity from Zimbabwe regarding its plans to phase out the use of the US dollar by 2030. This is significant because the local currency, the ZiG, has not yet gained widespread acceptance among the population. Understanding the implications of this shift is crucial for economic stability in Zimbabwe.

— Curated by the World Pulse Now AI Editorial System