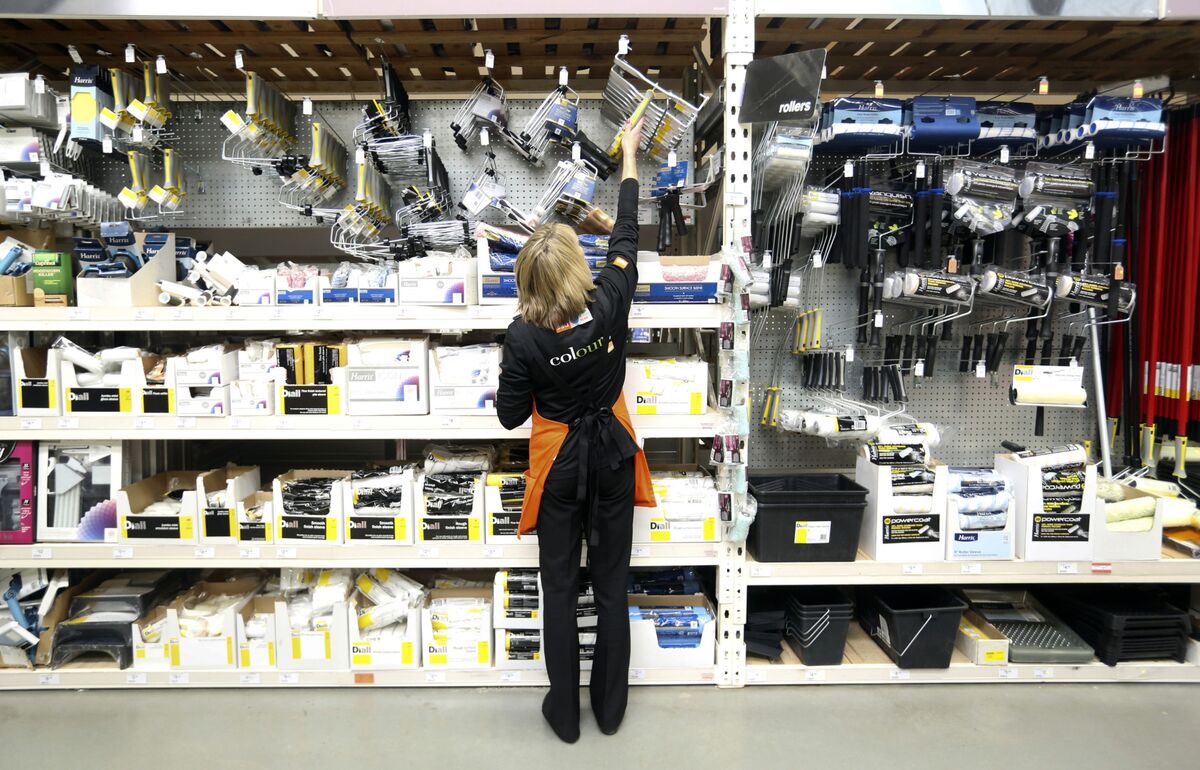

B&Q Owner Kingfisher Jumps on Higher Profit, Outlook Boost

PositiveFinancial Markets

Kingfisher Plc, the owner of B&Q, has seen its shares soar the most since 2008 following a report of higher profits and an upgraded outlook. This surge is significant as it reflects the company's strong performance in the home improvement sector, which is crucial for investors looking for stability and growth in a fluctuating market.

— Curated by the World Pulse Now AI Editorial System