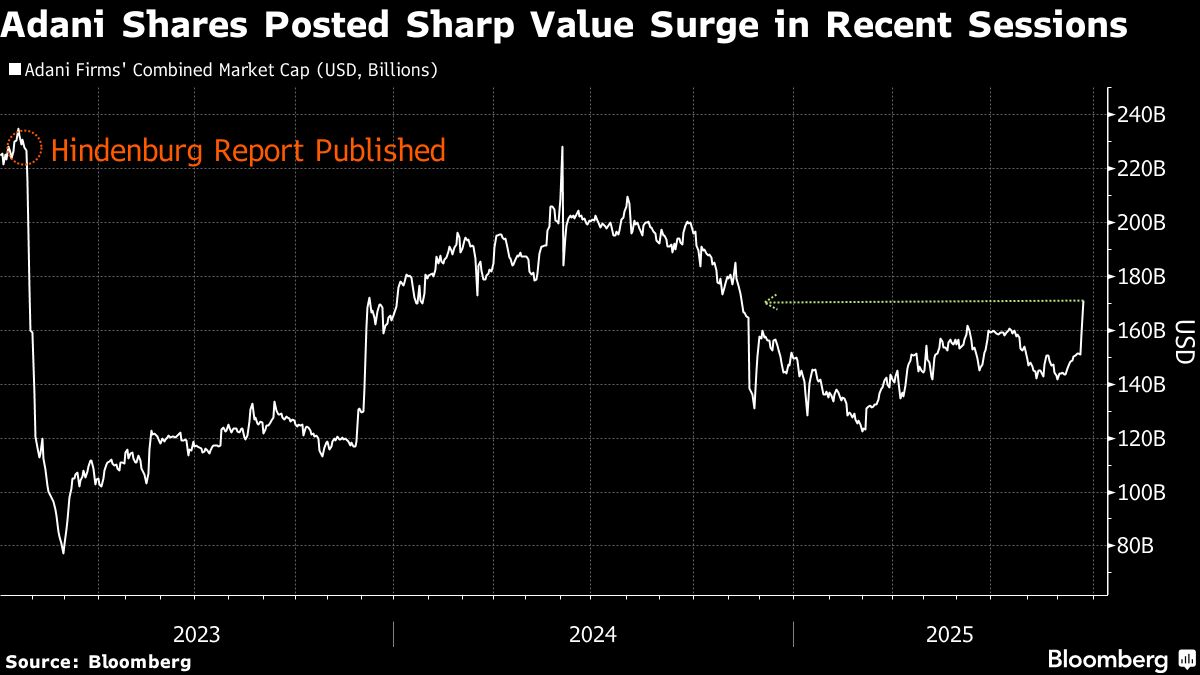

Baidu shares drop 7% in Hong Kong after strong monthly rally

NegativeFinancial Markets

Baidu's shares have experienced a significant drop of 7% in Hong Kong following a strong monthly rally. This decline raises concerns among investors about the sustainability of the company's recent gains and the overall market sentiment. Understanding these fluctuations is crucial for stakeholders as they navigate the volatile landscape of tech stocks.

— Curated by the World Pulse Now AI Editorial System