Copper Hits Highest in Over a Year on Disruptions, Fed Outlook

PositiveFinancial Markets

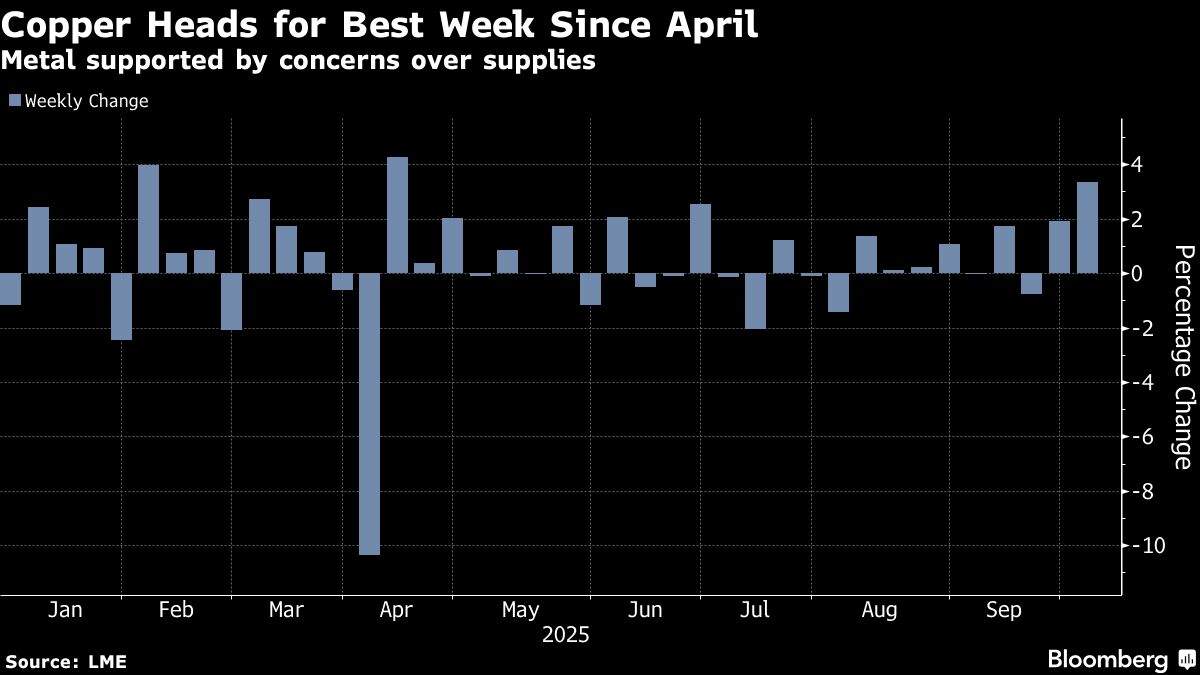

Copper prices have surged to their highest levels in over a year, driven by global supply disruptions and the anticipation of lower interest rates that could stimulate demand for this essential industrial metal. This rise is significant as it reflects broader economic trends and investor confidence, suggesting a potential recovery in manufacturing and construction sectors.

— Curated by the World Pulse Now AI Editorial System