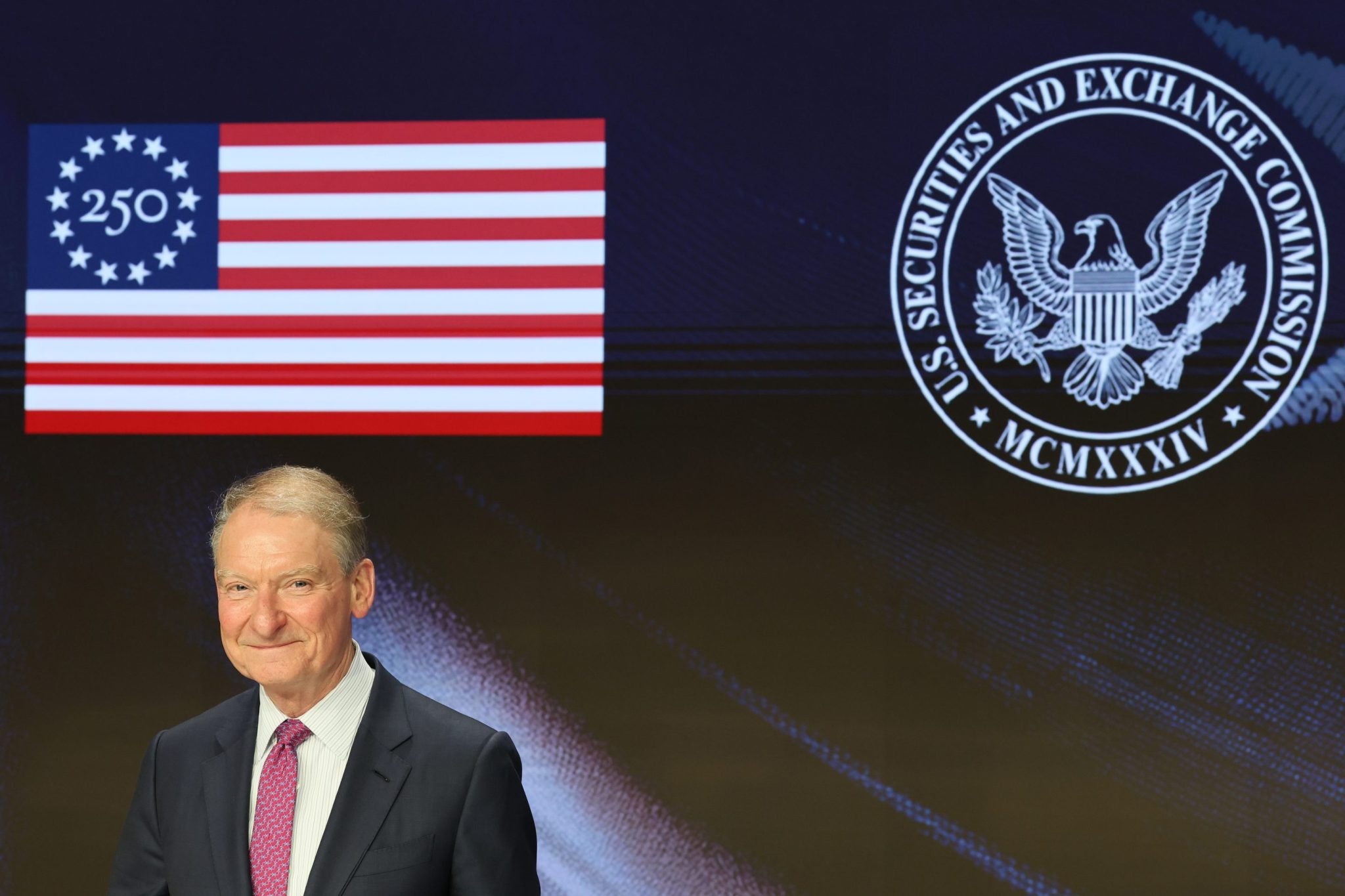

SEC Calls ‘Time Out’ On Wall Street’s Leverage Games

NeutralFinancial Markets

- The SEC has announced a pause on Wall Street's leverage practices, indicating a shift in regulatory scrutiny aimed at managing financial risks. This decision comes amid concerns about excessive leverage in the market, which could pose systemic risks to the financial system.

- This development is significant as it reflects the SEC's commitment to ensuring market stability and protecting investors from potential downturns associated with high leverage. It signals a more cautious approach to financial practices that could lead to instability.

- In contrast, Europe is perceived to still offer good value in the equity market, as noted by analysts who highlight the performance of quality stocks on both sides of the Atlantic. While Wall Street faces challenges, the European market continues to attract attention for its relative stability and potential for growth.

— via World Pulse Now AI Editorial System