Panama Ports Deal Hits Impasse as China Makes New Demands for Its Approval

NegativeFinancial Markets

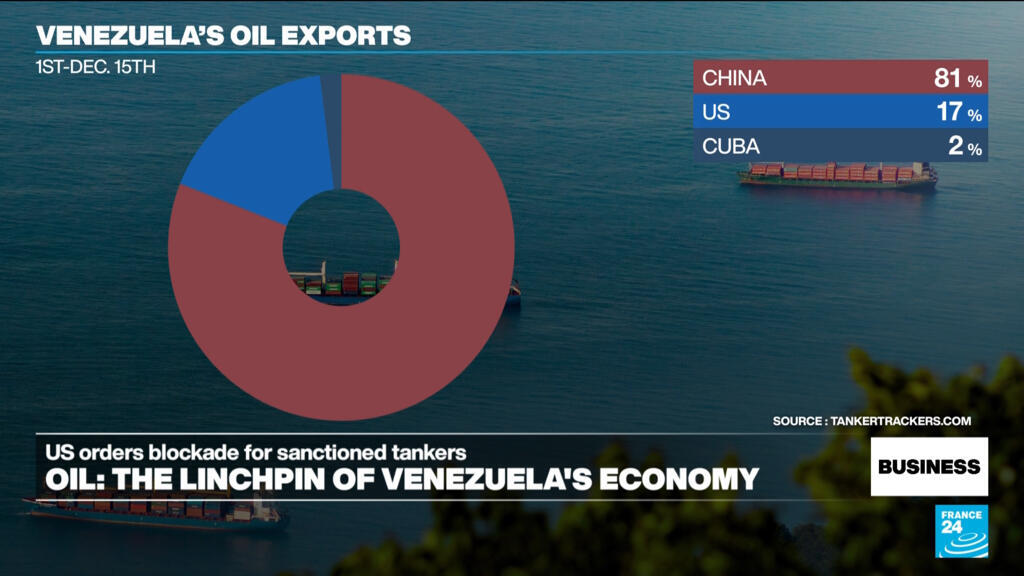

- The proposed deal for Panama's ports, led by BlackRock, has reached a stalemate as China demands that state-owned Cosco be granted a majority stake for approval. This impasse highlights the complexities involved in international investment negotiations, particularly when state interests are at play.

- The outcome of this negotiation is crucial for BlackRock, as securing the deal could enhance its portfolio in a strategically significant region. However, the requirement from China complicates the situation, potentially jeopardizing the investment and impacting Panama's economic landscape.

- This situation reflects broader trends in global trade, where China's increasing influence in port infrastructure raises concerns among other nations. As China continues to assert its dominance in shipping and trade, the implications for international relations and market dynamics become more pronounced, particularly amid ongoing tensions with other global powers.

— via World Pulse Now AI Editorial System