See Positive Backdrop For Credit: BNP Paribas' Robson

PositiveFinancial Markets

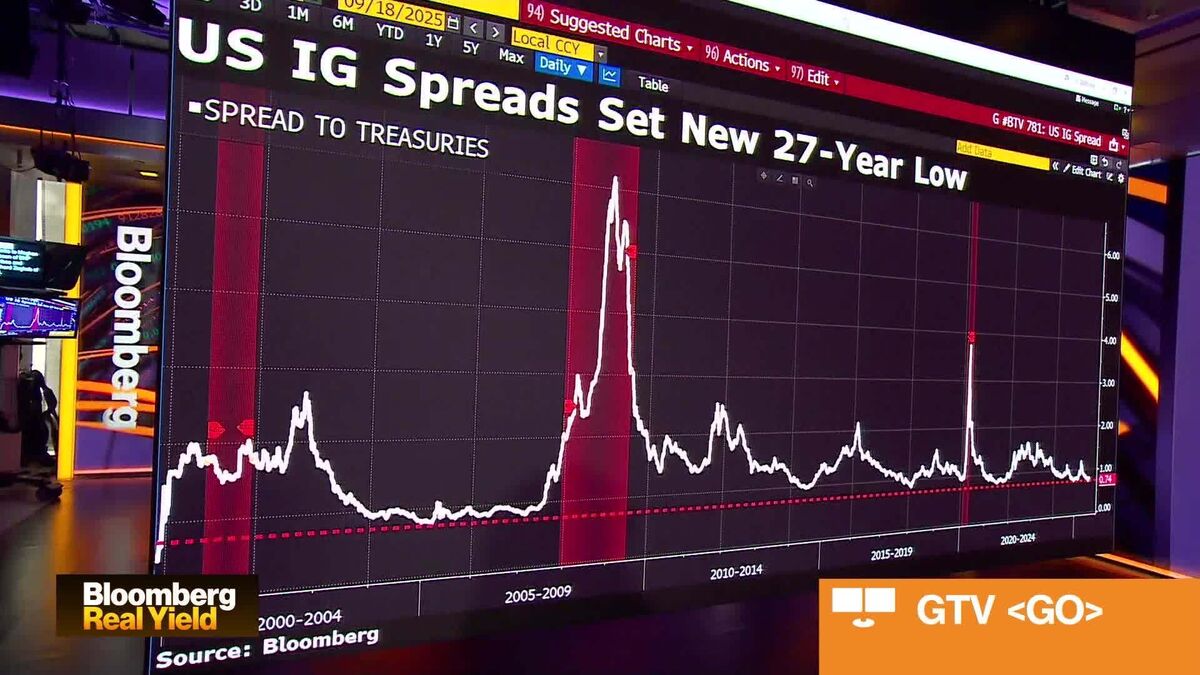

Meghan Robson, the Head of US Credit Strategy at BNP Paribas, has expressed an optimistic outlook for the credit market. This positive sentiment is echoed by Richard Zogheb from Citi, who is hopeful for an increase in mergers and acquisitions. Their insights, shared during a discussion with Vonnie Quinn on 'Real Yield,' highlight the potential for growth in the credit sector, which is crucial for investors and businesses looking to navigate the financial landscape.

— Curated by the World Pulse Now AI Editorial System