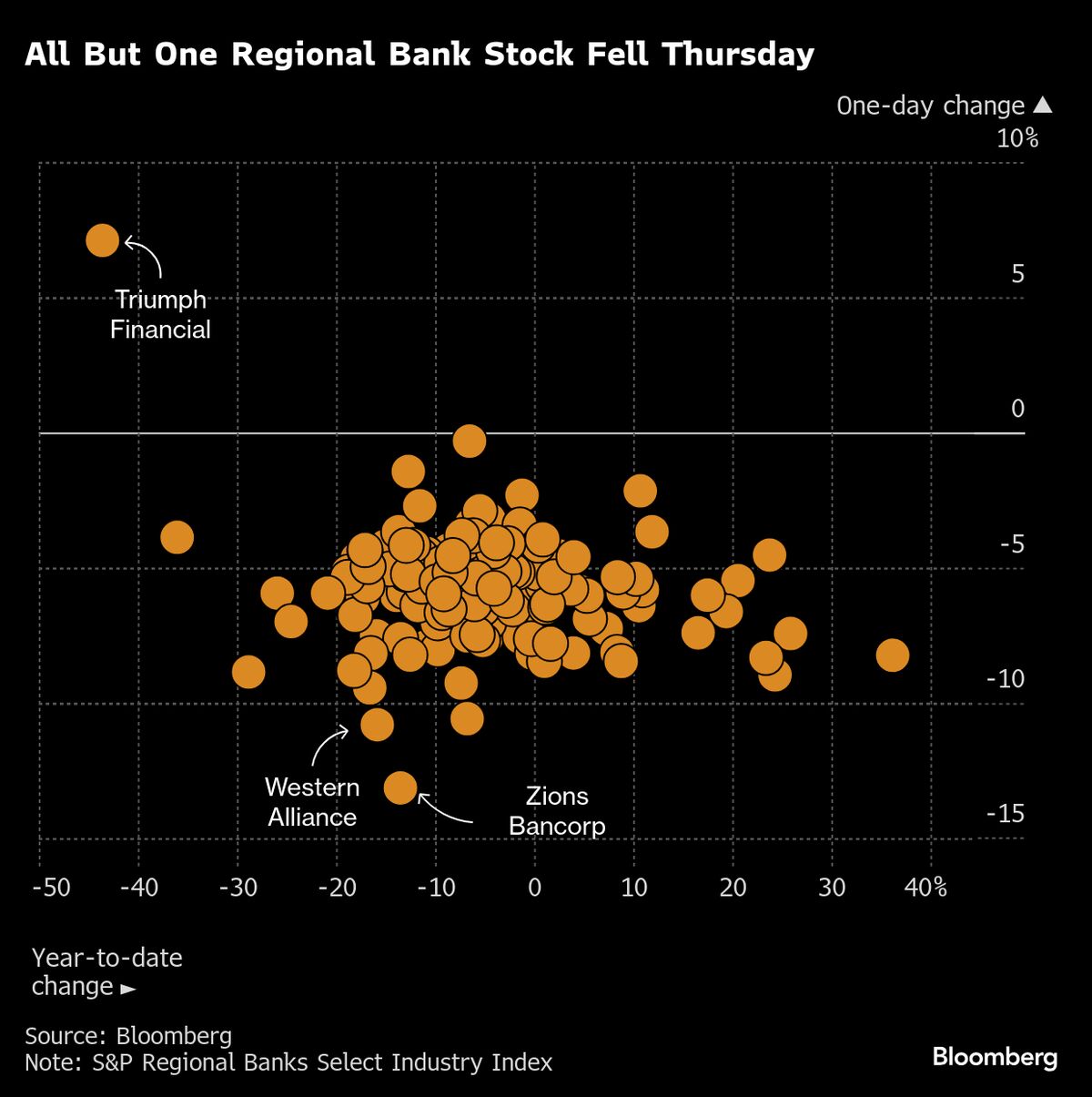

Wall Street ends down; Zions sparks worries about regional banks

NegativeFinancial Markets

Wall Street closed lower as concerns about regional banks were reignited by Zions Bancorporation's recent performance. This downturn reflects broader anxieties in the financial sector, particularly regarding the stability of smaller banks amidst economic uncertainties. Investors are closely monitoring these developments, as they could signal potential risks for the banking industry and the economy at large.

— Curated by the World Pulse Now AI Editorial System