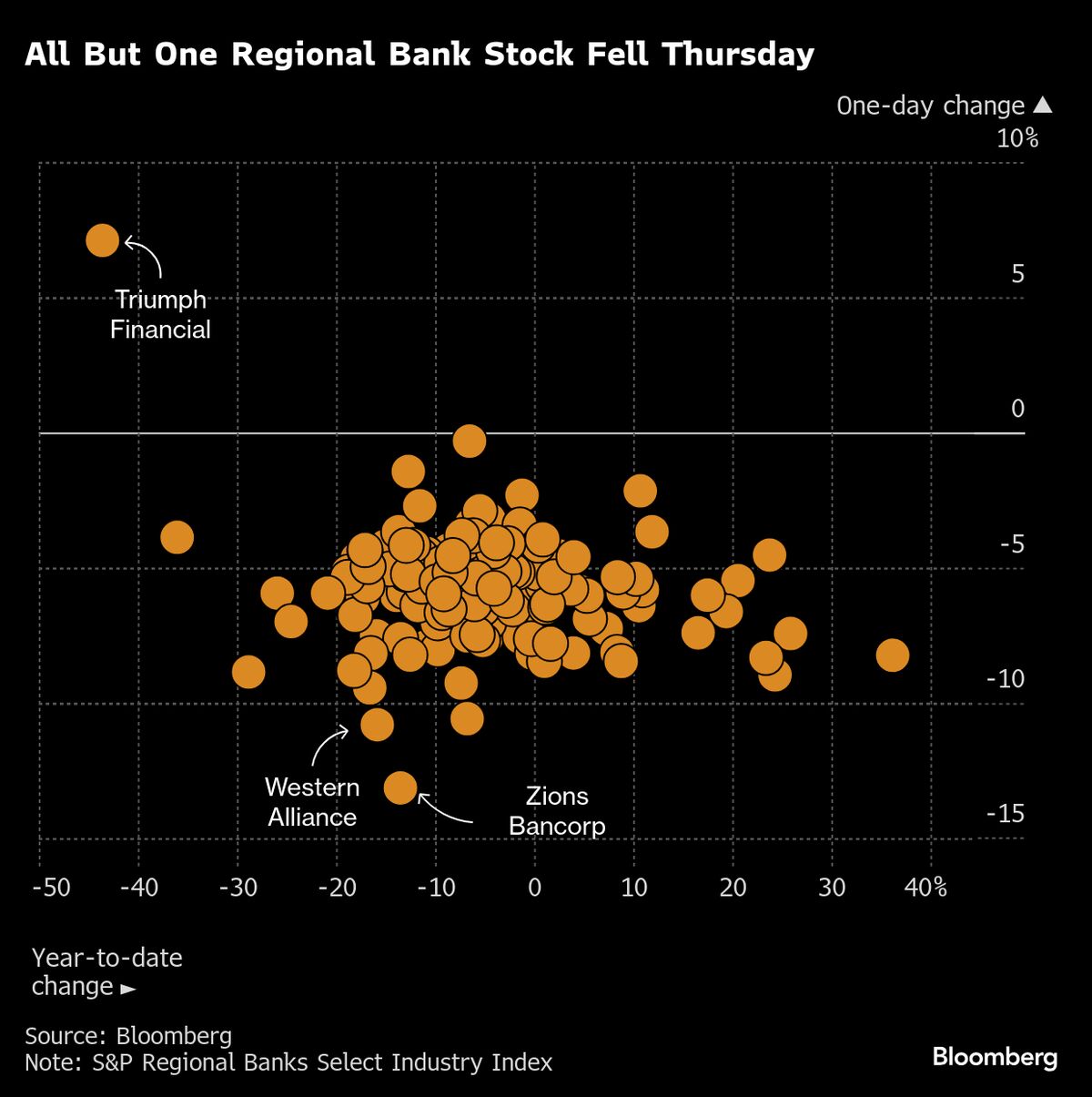

Regional Banks Tumble as Traders Sell First, Ask Questions Later

NegativeFinancial Markets

Recent turmoil in regional bank stocks has led to a significant sell-off, reflecting a growing sentiment among traders to act quickly without fully understanding the implications. This trend of 'sell first, ask questions later' raises concerns about market stability and investor confidence, as many fear the long-term effects of such hasty decisions.

— Curated by the World Pulse Now AI Editorial System