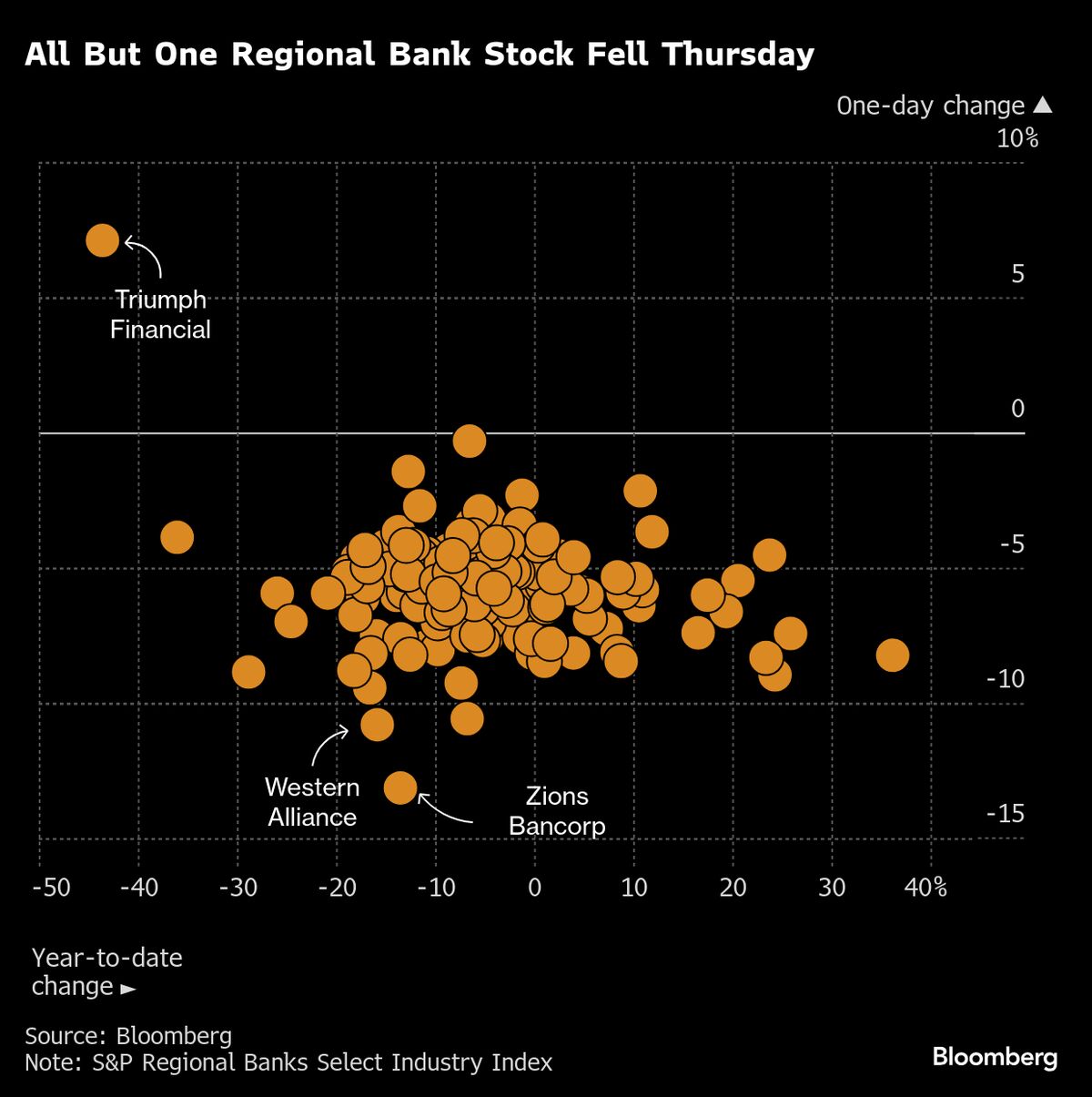

Regional Bank Worries Weigh on Stocks

NegativeFinancial Markets

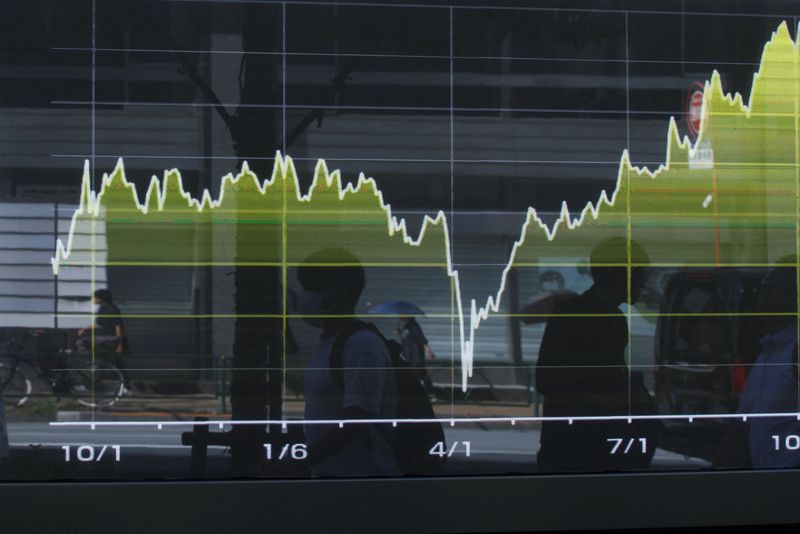

Stocks took a hit as concerns over regional banks intensified, marking the worst day for an index of these lenders since the turmoil caused by tariffs in April. This decline is significant as it reflects growing worries about the stability of regional banks, which can have broader implications for the financial market and investor confidence.

— Curated by the World Pulse Now AI Editorial System