Bitcoin Falls Nearly 30% From 2025 Peak

NegativeFinancial Markets

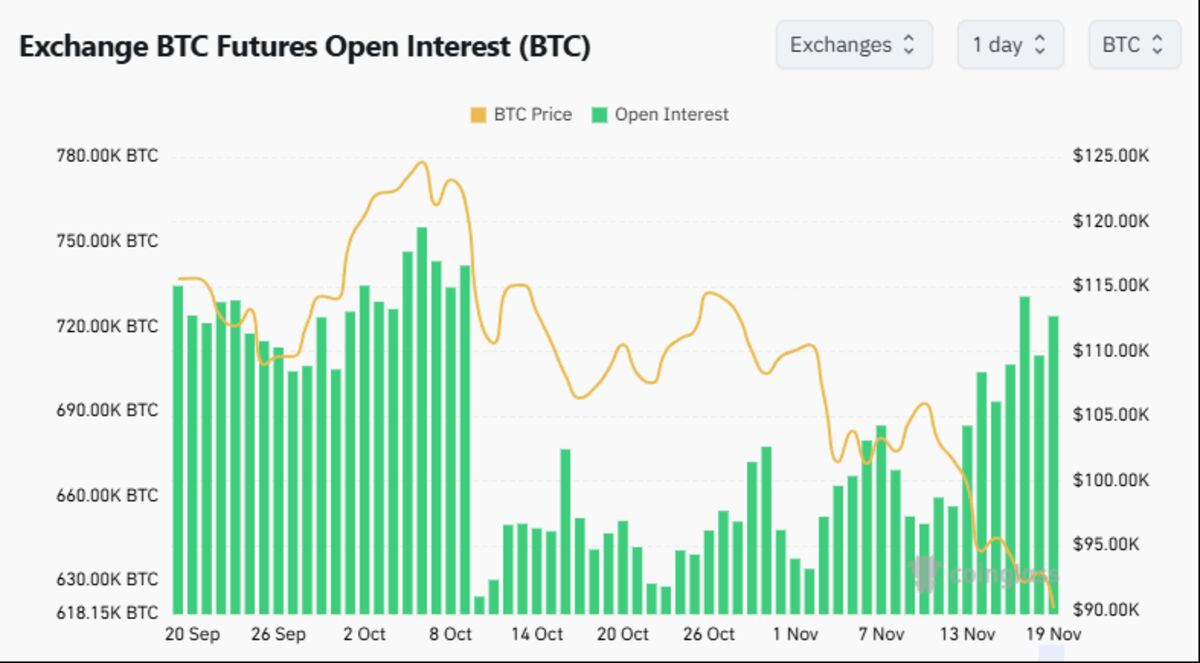

- Bitcoin's recent decline below $90,000 reflects a broader downturn in the cryptocurrency market, with the largest token dropping nearly 30% from its 2025 peak of over $126,000. This downturn has been exacerbated by increased caution among traders and a general decline in global financial markets.

- The significant drop in Bitcoin's value has erased its gains for 2025, impacting investor sentiment and raising concerns about the stability of the cryptocurrency market. This situation mirrors past market volatility linked to political and economic factors.

- The ongoing decline in Bitcoin's price highlights the fragility of market confidence, as traders move away from speculative assets amid fears of further selling pressure. The cryptocurrency market has shed approximately $1.2 trillion, reflecting a broader retreat in global financial markets and raising questions about the future of digital assets.

— via World Pulse Now AI Editorial System