Fed Cut This Week May Be Last for A While

NeutralFinancial Markets

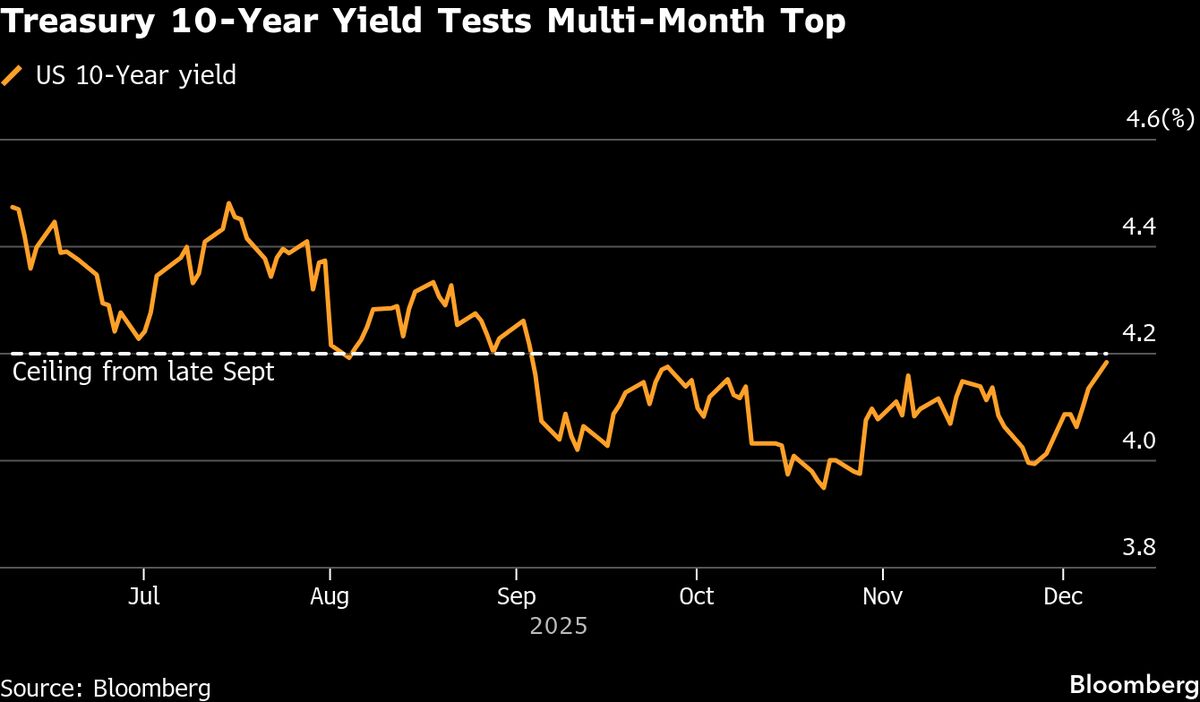

- The Federal Reserve is set to implement a third consecutive interest-rate cut, signaling a potential shift in monetary policy as officials prepare for their upcoming meeting. This decision comes amidst ongoing economic uncertainty and inflation concerns, which have influenced the Fed's deliberations on interest rates.

- This anticipated cut is significant as it reflects the Fed's response to recent disappointing job data and broader economic indicators, which have raised concerns about the labor market and overall economic health. Investors are closely watching these developments for their potential impact on financial markets.

- The decision to cut rates may also indicate a broader trend of easing monetary policy, as financial markets are increasingly betting on further cuts in the coming year. However, internal divisions within the Fed regarding inflation and economic stability complicate the outlook, suggesting that future rate adjustments may not be as straightforward.

— via World Pulse Now AI Editorial System