Fed splits ahead of key December meeting as rate-cut debate grows

NeutralFinancial Markets

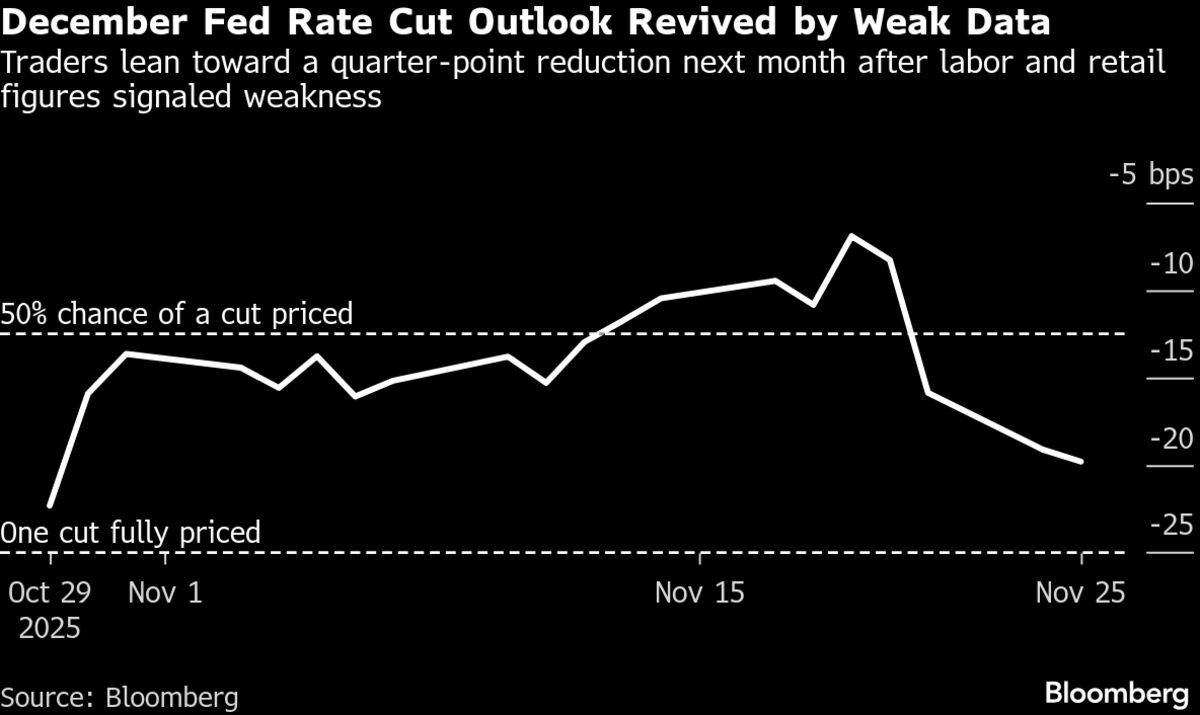

- The Federal Reserve is facing significant internal divisions as it approaches its December meeting, where a decision on a potential interest rate cut for the third time this year is expected. Policymakers are split on how to address a weakening labor market while managing rising inflation, leading to uncertainty about the central bank's direction.

- This division among Federal Reserve officials is crucial as it reflects differing views on the economic outlook and the appropriate monetary policy response. The outcome of the December meeting could have substantial implications for financial markets and economic stability.

- The ongoing debate within the Federal Reserve highlights a broader struggle to balance economic growth with inflation control. As investors increasingly bet on a rate cut, the central bank's decision

— via World Pulse Now AI Editorial System