Vanguard has a change of heart on crypto, lists Bitcoin and other ETFs

PositiveFinancial Markets

- Vanguard, a brokerage firm previously resistant to cryptocurrency, has announced the listing of Bitcoin and other blockchain-wrapped exchange-traded funds (ETFs), allowing traders to buy and sell these assets. This marks a significant shift in Vanguard's stance towards digital currencies, reflecting a growing acceptance of crypto in traditional finance.

- This development is crucial for Vanguard as it opens new revenue streams and aligns the firm with evolving market trends, potentially attracting a new clientele interested in cryptocurrency investments. By embracing crypto ETFs, Vanguard positions itself as a more competitive player in the financial services industry.

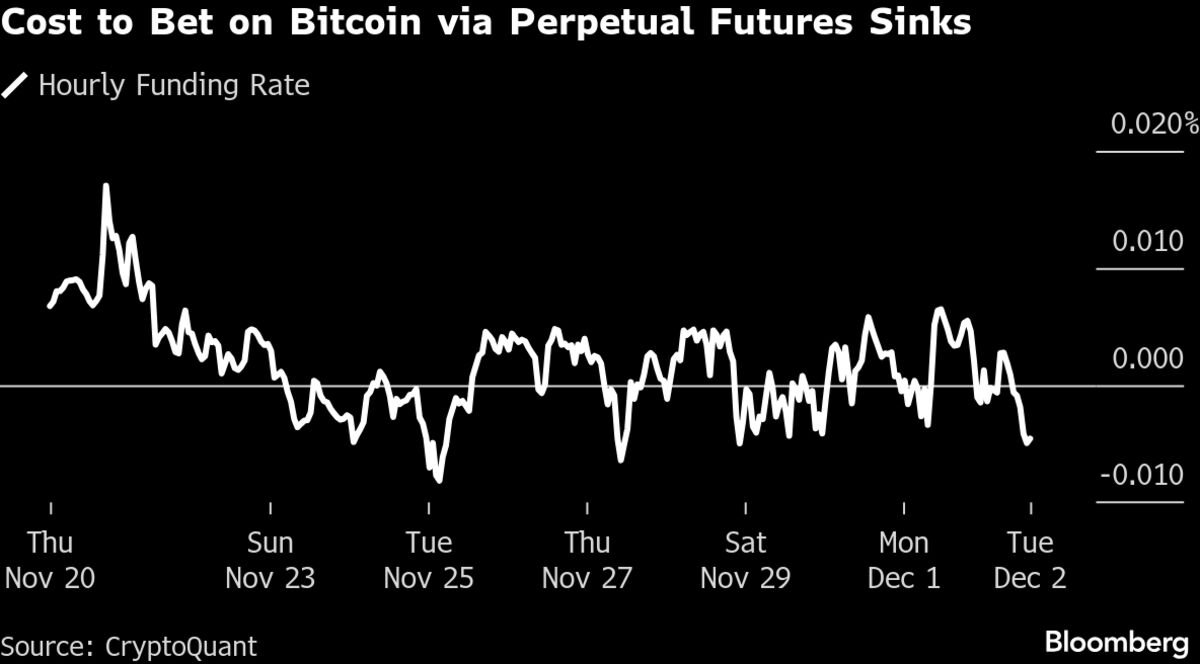

- The broader cryptocurrency market is currently facing challenges, with Bitcoin experiencing a notable decline and investor confidence wavering. This context highlights the volatility and risks associated with crypto investments, as many traders are pulling back from speculative assets. Vanguard's entry into this space may be seen as a double-edged sword, as it could attract both new investors and scrutiny amid ongoing market fluctuations.

— via World Pulse Now AI Editorial System