Cattle Ranchers are Furious About Trump’s Plan to Import More Argentine Beef

NegativeFinancial Markets

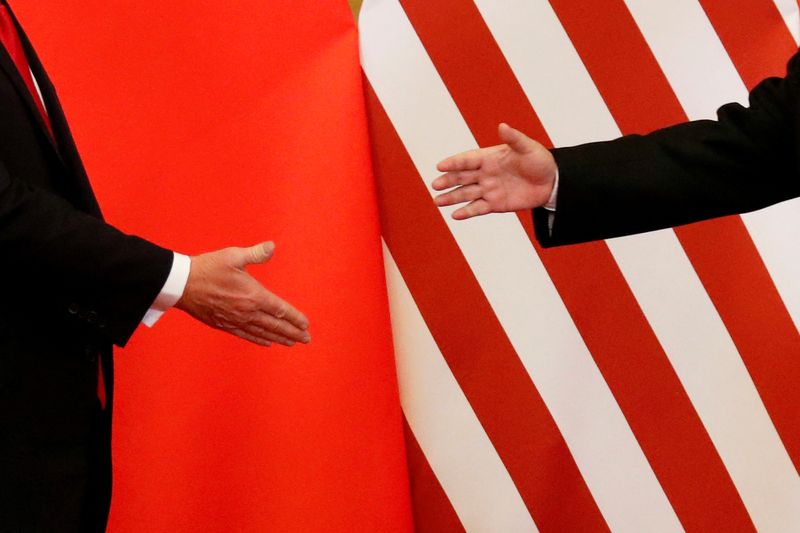

Cattle ranchers in the U.S. are expressing their anger over President Trump's proposal to increase imports of Argentine beef. This plan has raised concerns among local ranchers who fear it could undermine their livelihoods and affect the domestic beef market. The situation highlights the ongoing tension between international trade policies and local agricultural interests, making it a significant issue for both ranchers and consumers.

— Curated by the World Pulse Now AI Editorial System