Asia FX heads for sharp weekly losses on Fed rate caution; Tokyo CPI in focus

NegativeFinancial Markets

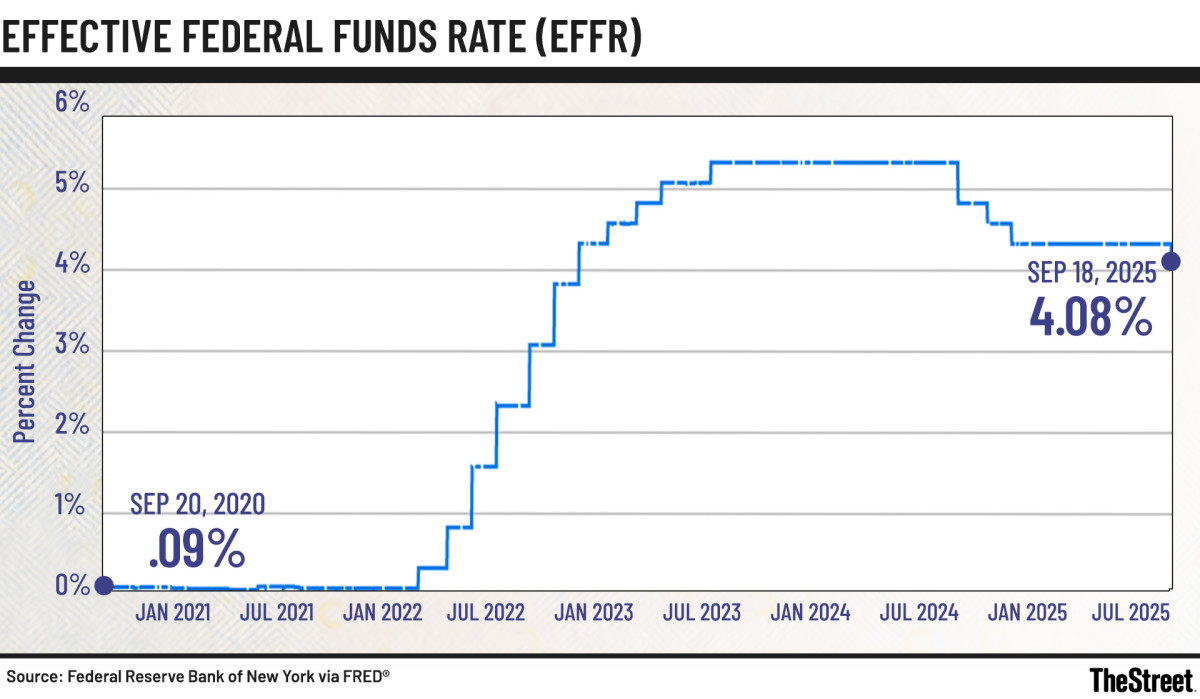

This week, Asian currencies are facing significant losses as investors react to the Federal Reserve's cautious stance on interest rates. The focus is particularly on Tokyo's Consumer Price Index (CPI), which could influence market sentiment further. Understanding these developments is crucial as they reflect broader economic trends and can impact trade and investment decisions across the region.

— Curated by the World Pulse Now AI Editorial System