Gold and Silver Gain to Start Week

PositiveFinancial Markets

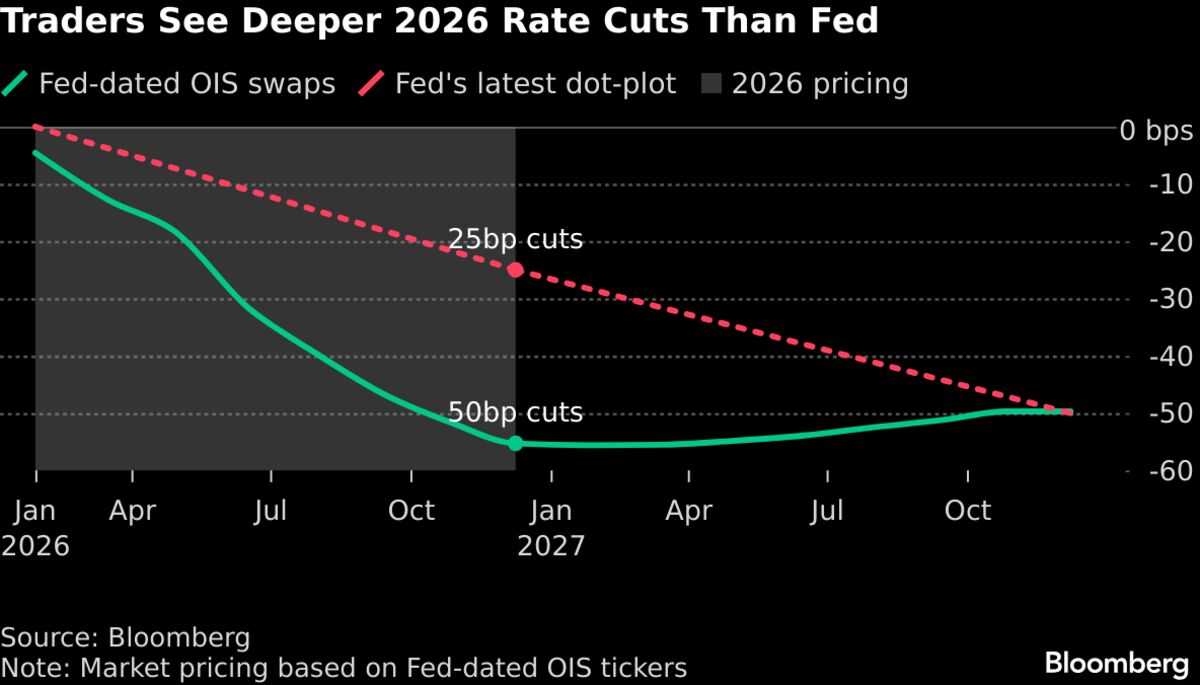

- Gold and silver futures opened the week on a positive note, buoyed by expectations surrounding key economic reports that may influence the Federal Reserve's interest rate decisions in 2026. This upward trend reflects a growing investor interest in precious metals as safe-haven assets amid economic uncertainties.

- The increase in gold and silver prices is significant as it indicates a shift in market sentiment, particularly in light of potential interest rate cuts from the Federal Reserve, which could affect borrowing costs and overall economic activity.

- This development aligns with broader market trends where gold has been trading near record levels, driven by concerns over fiscal stability and the performance of technology stocks, highlighting a cautious approach among investors as they navigate economic volatility.

— via World Pulse Now AI Editorial System