Bond-Market Debate Over Fed’s Path in 2026 Is About to Heat Up

NeutralFinancial Markets

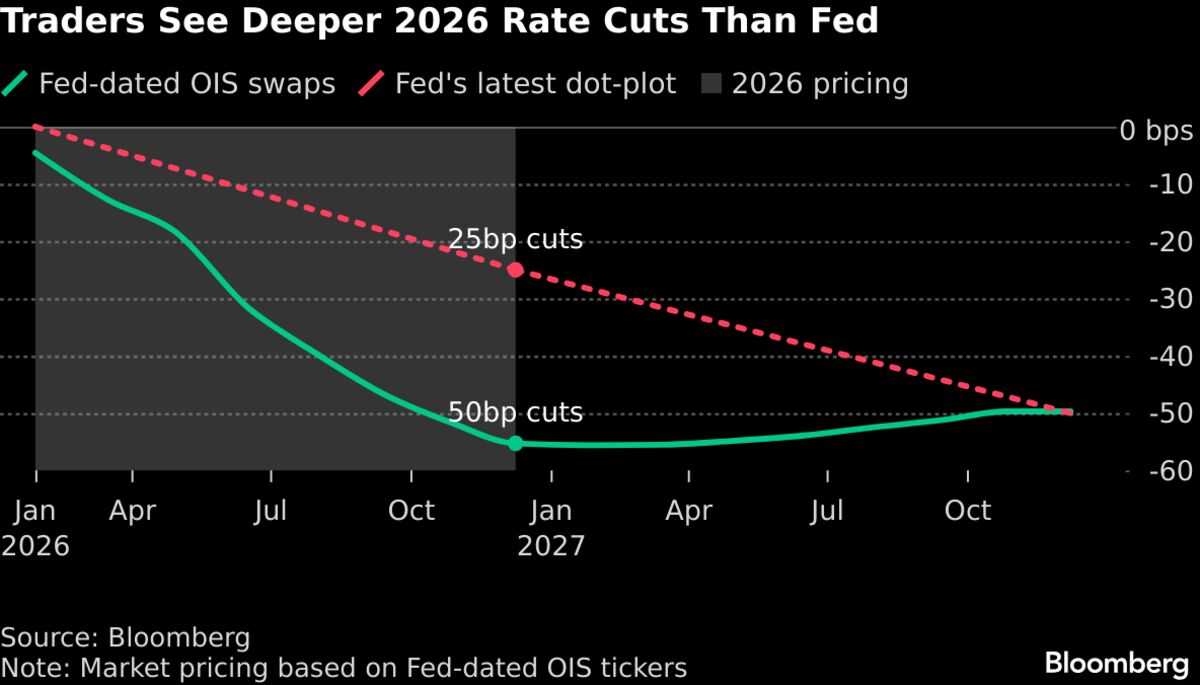

- The debate in the US Treasury market regarding the Federal Reserve's interest

- This development is crucial as it reflects the Federal Reserve's ongoing strategy to manage economic growth and inflation, with implications for borrowing costs and investment decisions across various sectors. The market's reaction to anticipated cuts could impact liquidity and overall economic stability.

- The situation highlights a broader trend of uncertainty within financial markets, where bond traders are expressing skepticism about prolonged rate cuts beyond December. This skepticism contrasts with some investors' expectations for further easing in 2026, indicating a divergence in market sentiment that could shape future monetary policy discussions.

— via World Pulse Now AI Editorial System