BOE Expected to Cut as ECB Settles Into Its Good Place

NeutralFinancial Markets

- The Bank of England (BOE) is anticipated to announce a cut in interest rates, aligning its policy direction with the European Central Bank (ECB), which is currently in a favorable position regarding inflation management. This decision comes as five European central banks prepare to reveal their monetary policies, with the BOE being the only one expected to follow the Federal Reserve's lead in rate cuts.

- This development is significant for the BOE as it reflects a response to ongoing economic pressures and aims to stimulate growth amid concerns about the labor market and inflation. The anticipated cut may also influence investor sentiment and market stability in the UK.

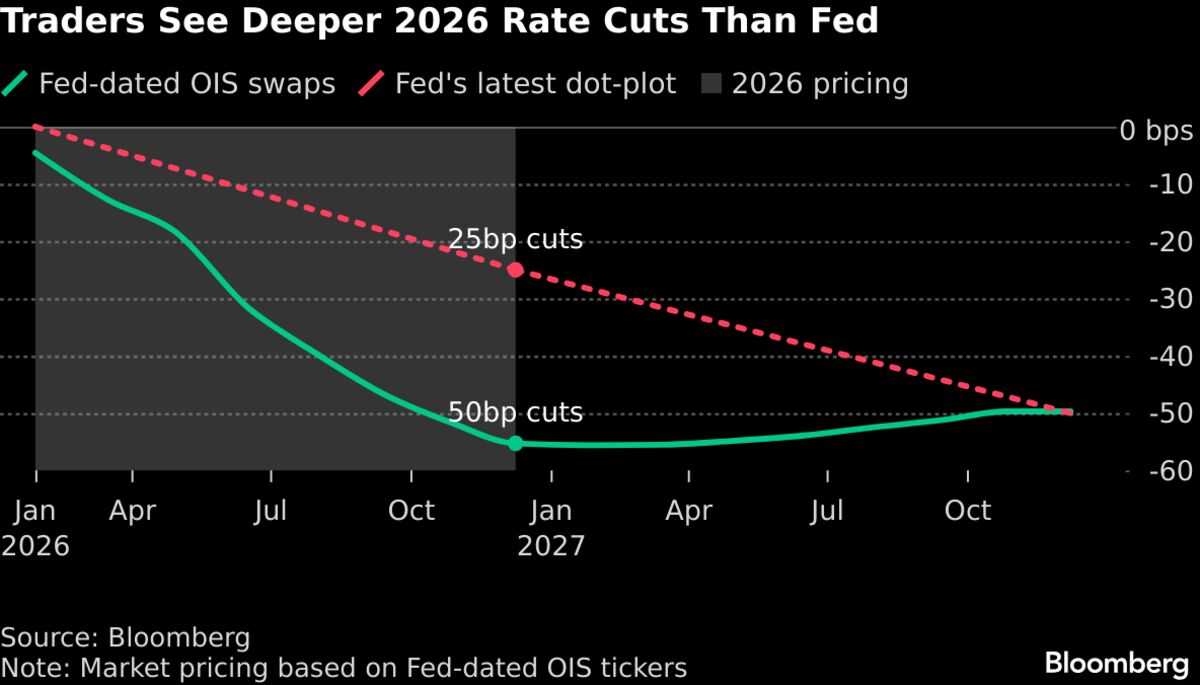

- The broader context highlights a divergence in monetary policy approaches among major central banks, with the ECB maintaining a stable outlook while the Federal Reserve faces internal debates over further rate cuts. As the ECB evaluates its position, the potential impact on the dollar and global markets remains a critical consideration for policymakers.

— via World Pulse Now AI Editorial System