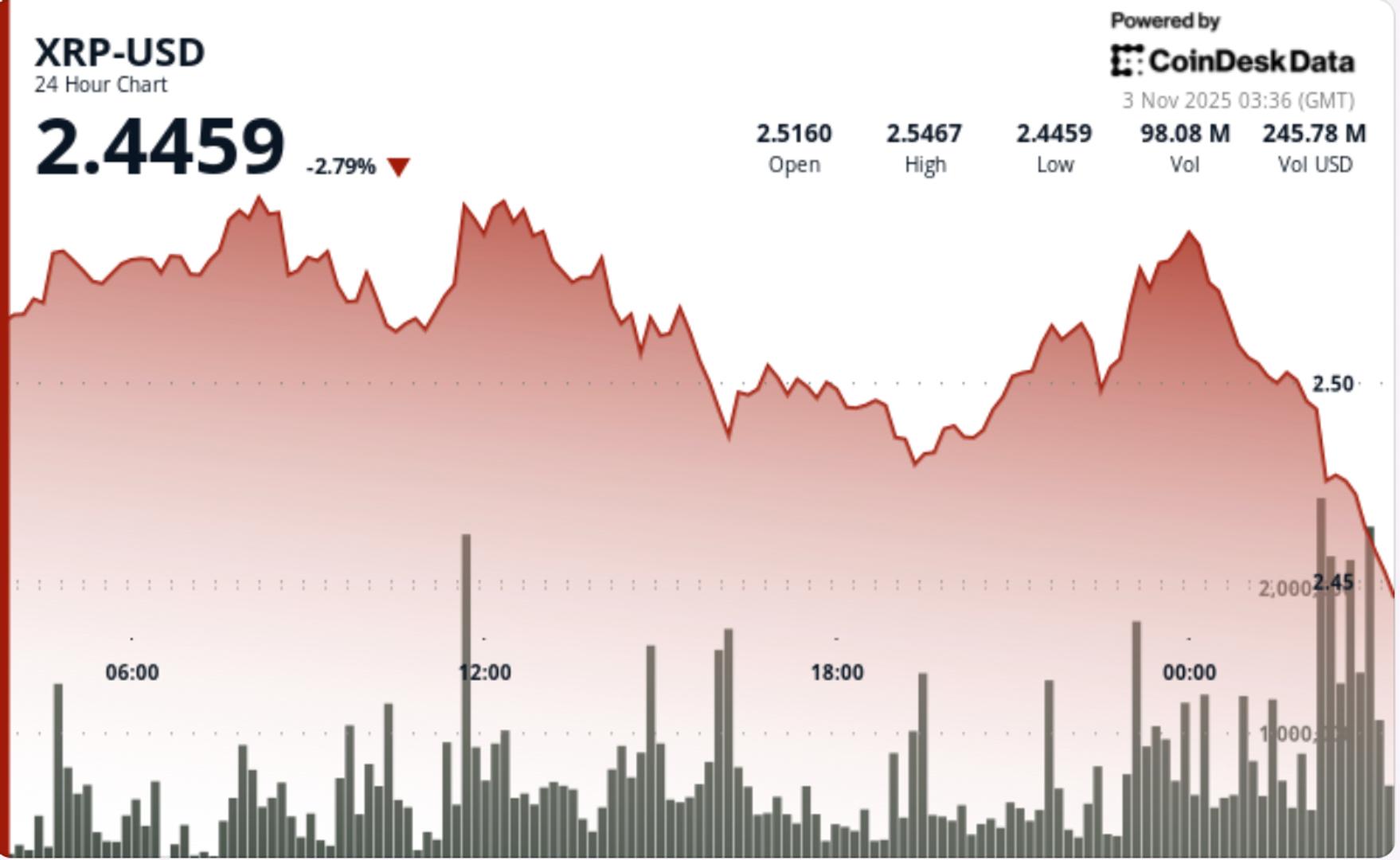

XRP Chart Turns Neutral, Repeated $2.55 Rejections Define Next Breakout Zone

NeutralCryptocurrency

The XRP market has recently shown a neutral trend, with the price repeatedly facing rejections at the $2.55 mark. This pattern indicates a critical breakout zone for traders and investors, as they closely monitor the cryptocurrency's movements. Understanding these price levels is essential for making informed trading decisions, especially in a volatile market.

— Curated by the World Pulse Now AI Editorial System