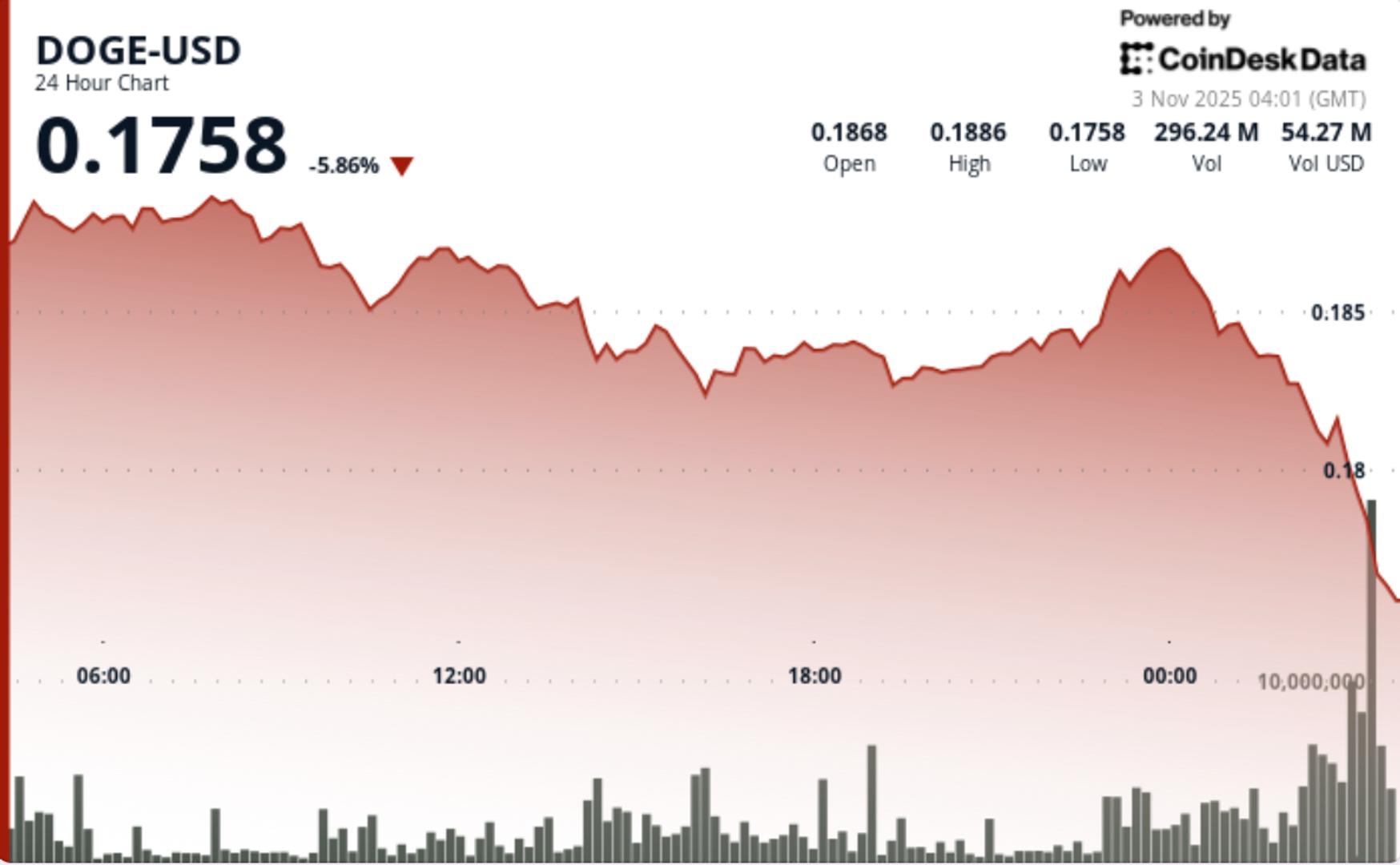

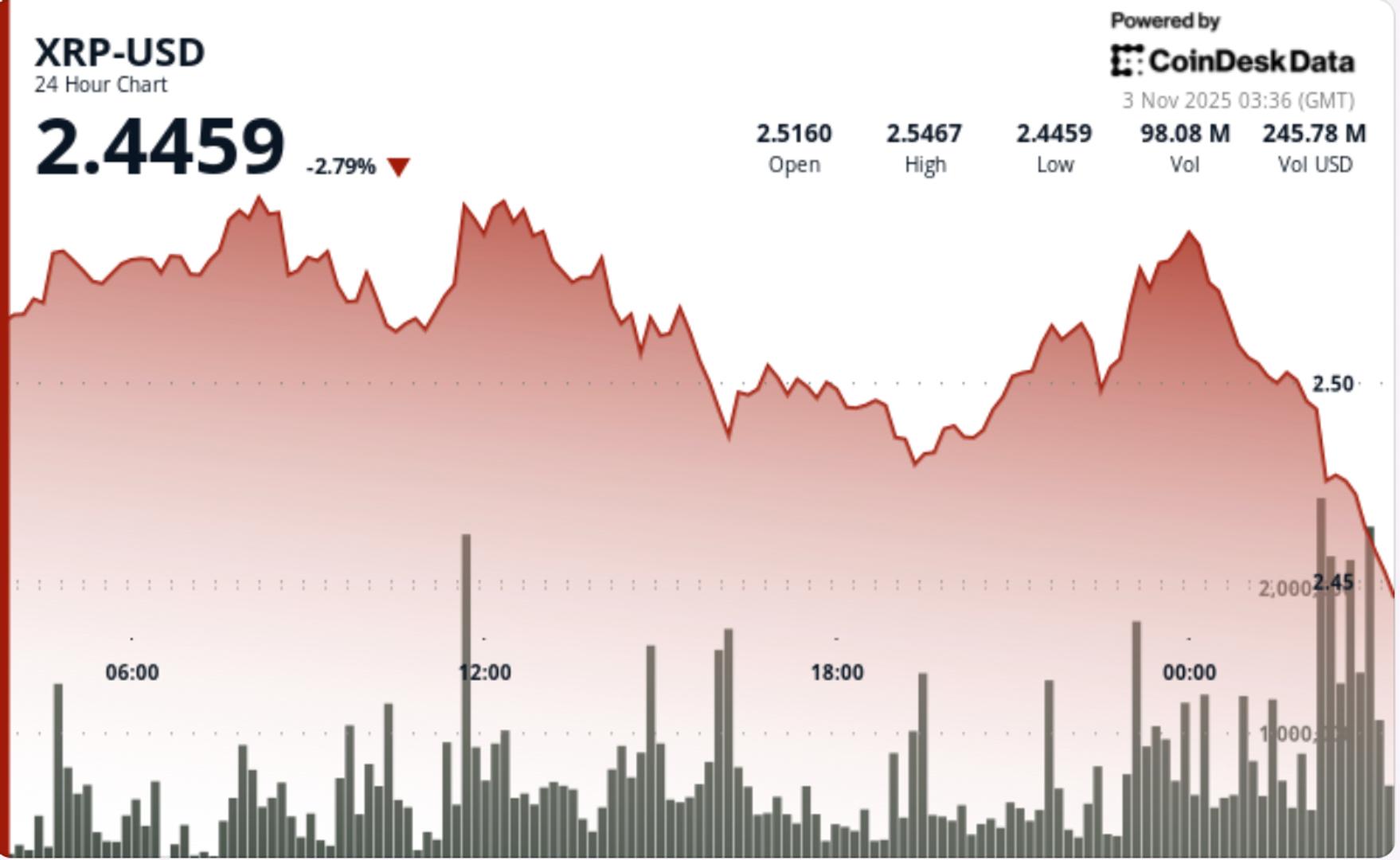

Bitcoin Breaks Down Again — Bearish Momentum Intensifies Across Crypto Market

NegativeCryptocurrency

Bitcoin is facing a significant downturn, dropping below $110,000 and showing signs of continued decline. This bearish momentum is concerning for investors as it indicates a potential further drop if the price remains under key resistance levels. The situation highlights the volatility of the crypto market and the challenges Bitcoin faces in maintaining its value, which could impact investor confidence and market stability.

— Curated by the World Pulse Now AI Editorial System