SGX's Crypto Futures Draw New Liquidity, Not Diverted Cash, Exchange's President Says

NeutralCryptocurrency

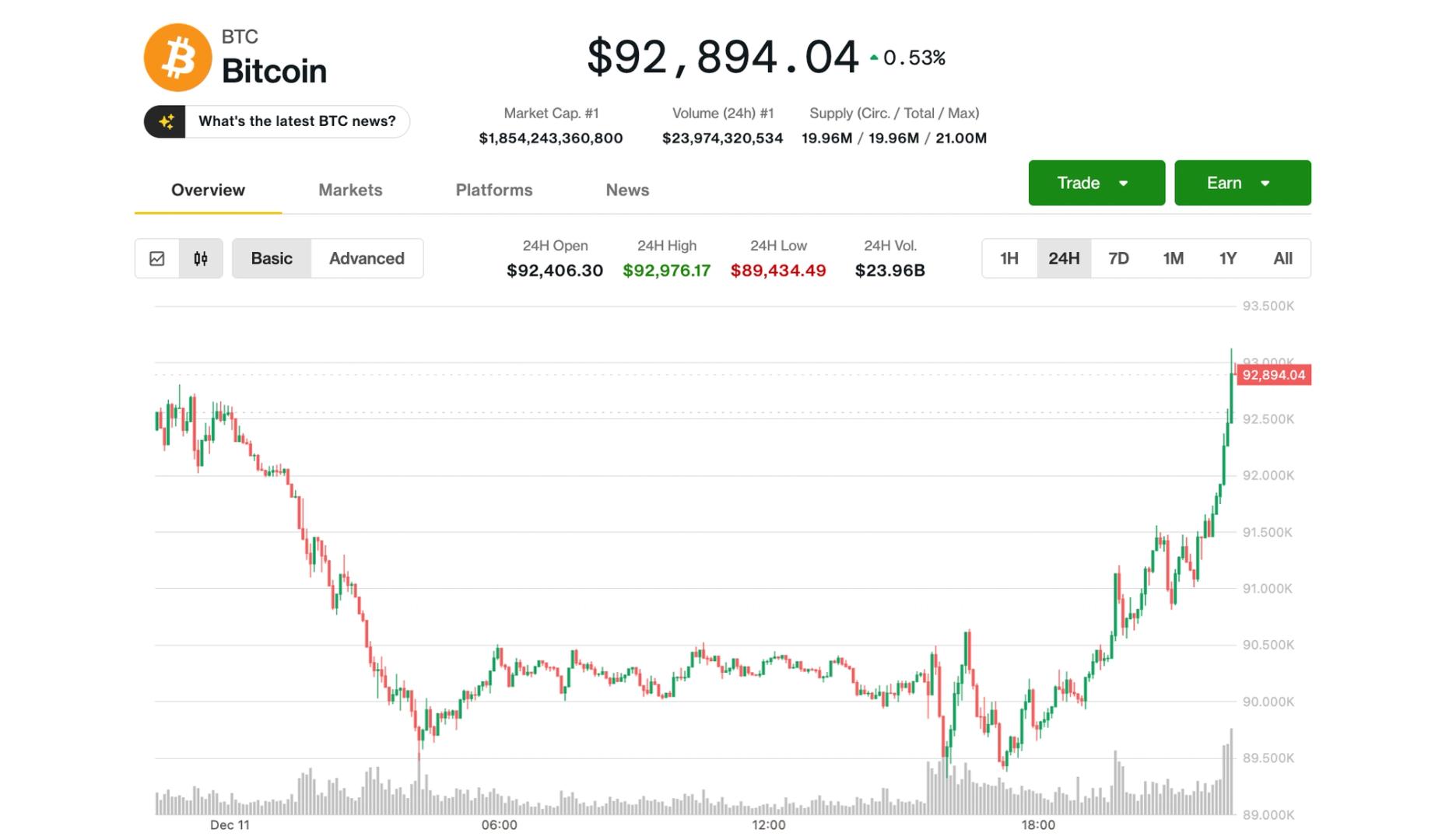

- SGX's president announced that the recent influx of liquidity into its cryptocurrency futures market is not a result of cash being diverted from other platforms, but rather new capital entering the market. This statement follows the successful launch of Bitcoin and Ethereum perpetual futures, which achieved a notable trading volume of $35 million on their debut day.

- This development is significant for SGX as it indicates a growing interest in its cryptocurrency offerings, potentially enhancing its competitive position in the evolving digital asset landscape and attracting more institutional investors.

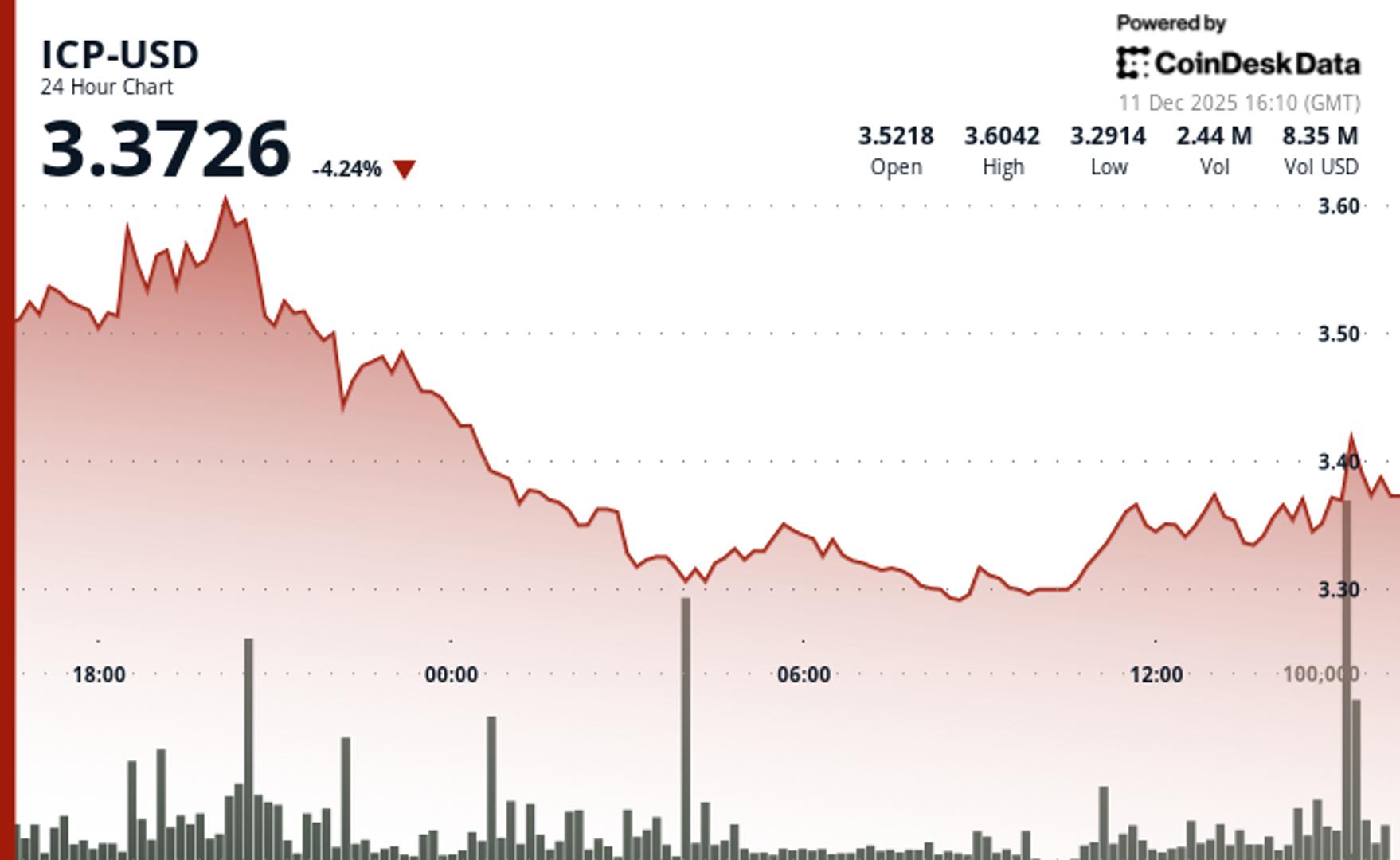

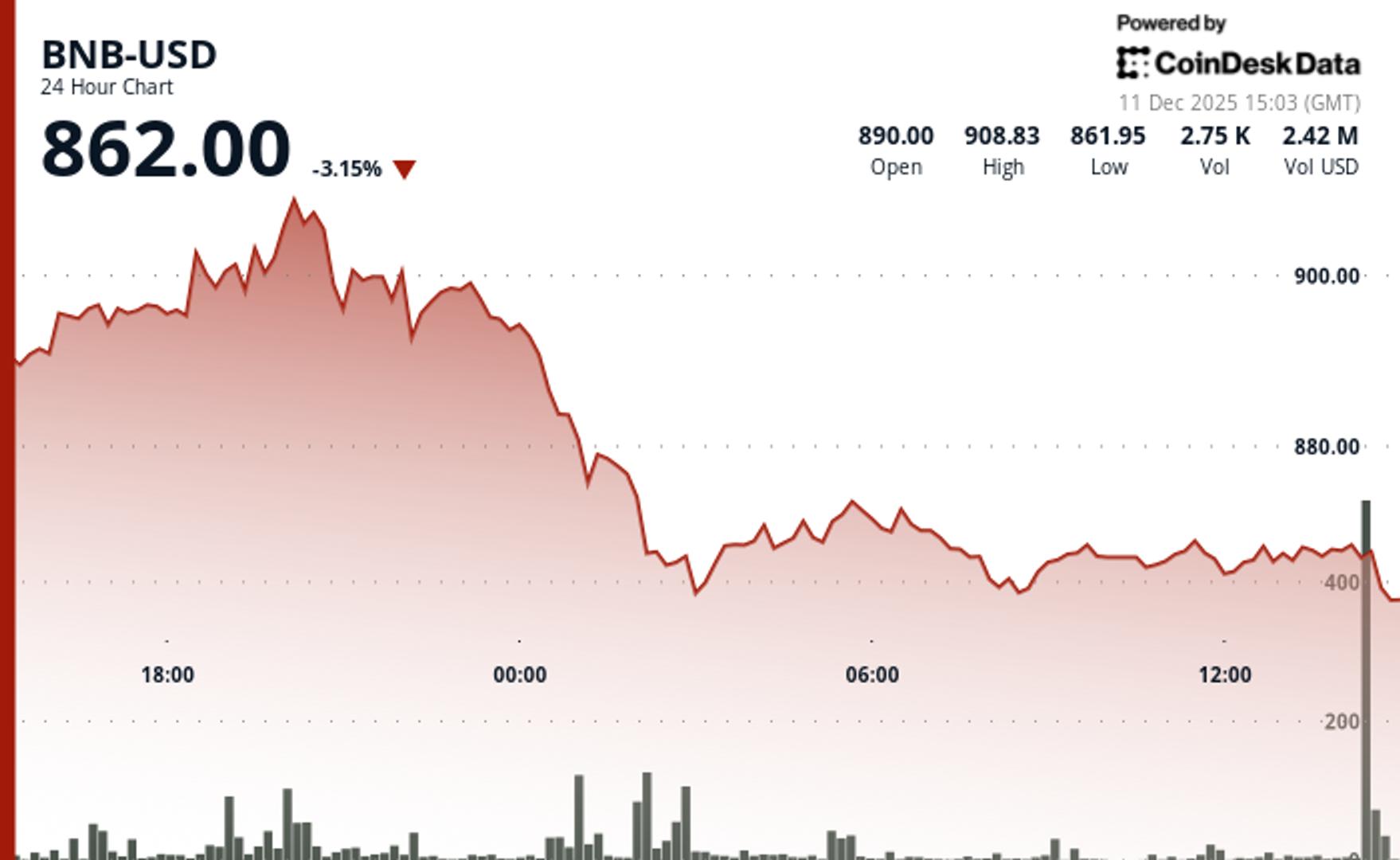

- The broader cryptocurrency market is currently experiencing volatility, with fluctuating prices and mixed investor sentiment. Despite challenges, there is a persistent confidence in strategic acquisitions and infrastructure improvements, suggesting that the sector is adapting and evolving amidst market fluctuations.

— via World Pulse Now AI Editorial System