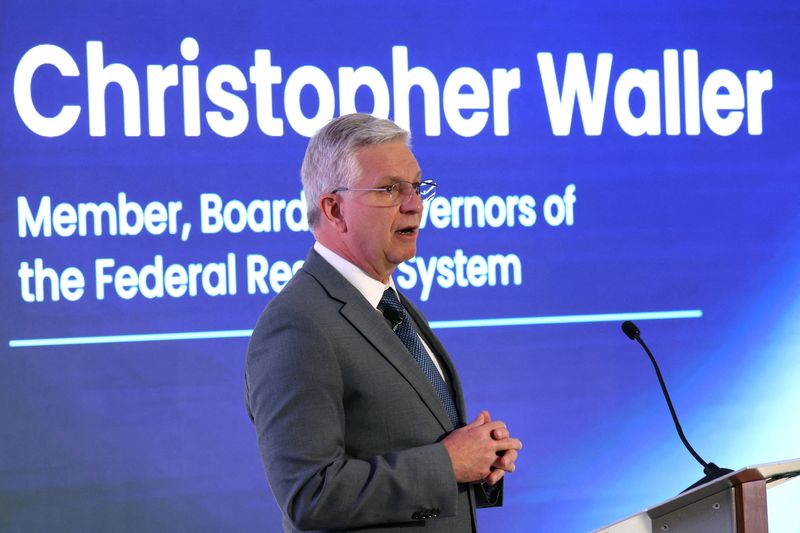

Fed governor Waller backs further rate cuts but urges caution

NeutralFinancial Markets

Federal Reserve Governor Christopher Waller has expressed support for further interest rate cuts, but he emphasizes the need for caution due to mixed signals regarding the health of the US economy. This is significant as it highlights the delicate balance policymakers must maintain while navigating economic uncertainties, which could impact inflation and growth.

— Curated by the World Pulse Now AI Editorial System