Trump's Ruthless Election Ultimatum to Argentina: $20B Bailout Hangs by a Thread if Milei Flops – A Diplomatic Dagger Exposed

NegativeFinancial Markets

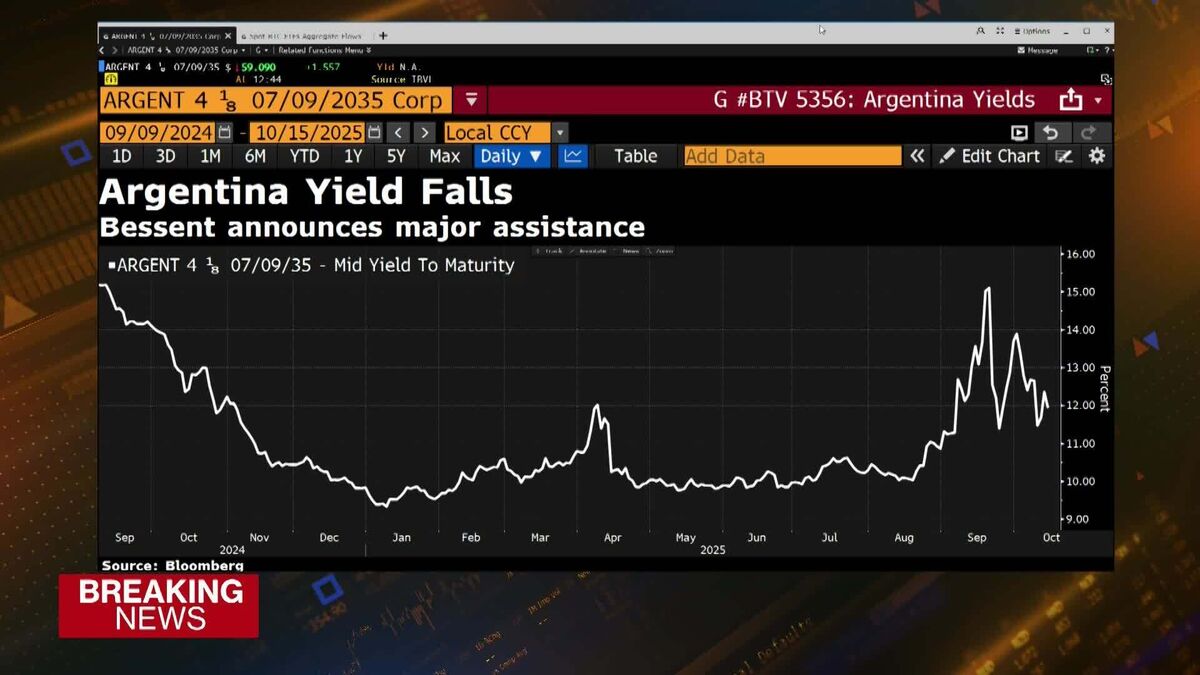

In a tense political climate, former U.S. President Donald Trump has issued a stark warning regarding the potential $20 billion bailout for Argentina, contingent on the success of President Javier Milei's administration. This ultimatum highlights the fragile nature of international support and the significant stakes involved in Milei's economic policies. If Milei fails to deliver on his promises, Argentina could face dire consequences, making this situation critical not just for the country but for broader U.S.-Latin American relations.

— Curated by the World Pulse Now AI Editorial System