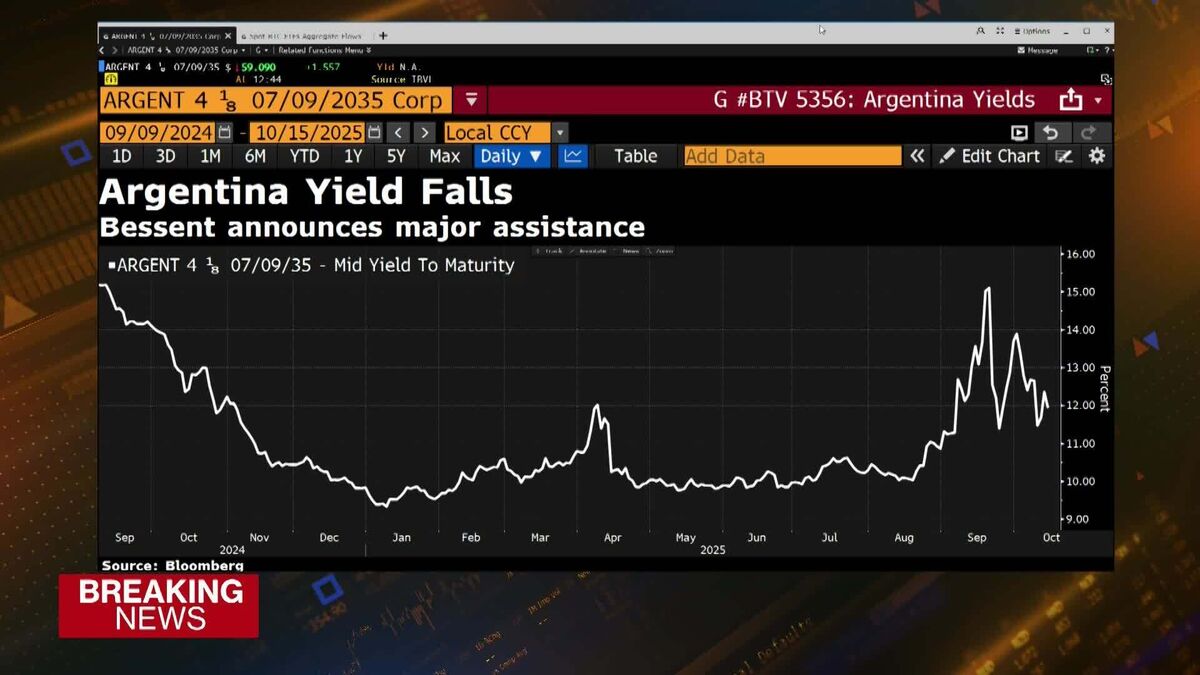

Argentine Bonds Jump on News US Lining Up $40 Billion in Aid

PositiveFinancial Markets

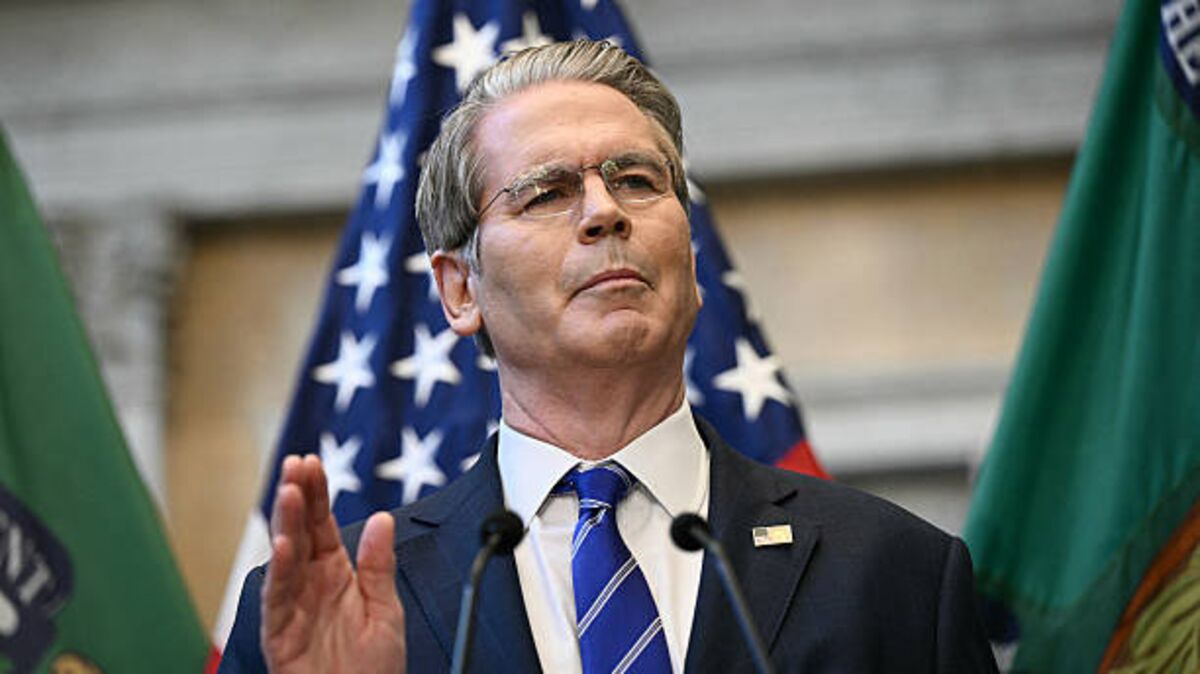

Argentina's sovereign bonds saw a significant increase on Wednesday following reports that US Treasury Secretary Scott Bessent is preparing to offer $40 billion in financial aid to President Javier Milei's government. This news is crucial as it signals potential stability and support for Argentina's economy, which has been facing challenges. The influx of funds could help bolster investor confidence and improve the country's financial situation.

— Curated by the World Pulse Now AI Editorial System