Silver Tops $60, Gold Advances as Traders Bet on Lower Rates

PositiveFinancial Markets

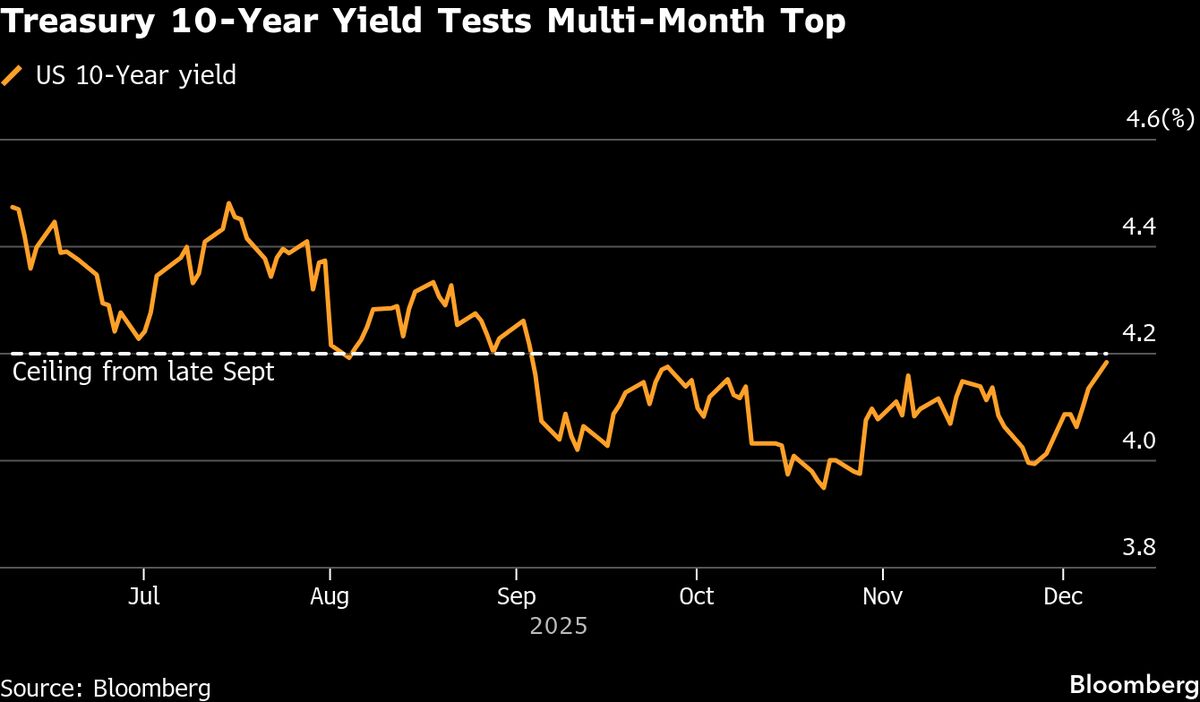

- Silver prices have surpassed $60 an ounce for the first time, driven by traders' expectations of further monetary easing from the Federal Reserve and ongoing supply constraints. This surge in silver prices is accompanied by a notable increase in gold prices, reflecting a broader trend in precious metals markets.

- The rise in silver and gold prices indicates a growing demand for safe-haven assets as investors react to economic uncertainties and potential shifts in monetary policy. This development is significant for traders and investors who are closely monitoring the Federal Reserve's actions.

- The recent surge in silver prices highlights a broader trend of increasing demand for precious metals amid economic volatility. Factors such as supply tightness and expectations of interest rate cuts by the Federal Reserve are influencing market dynamics, leading to fluctuations in both silver and gold prices as traders navigate the uncertain economic landscape.

— via World Pulse Now AI Editorial System